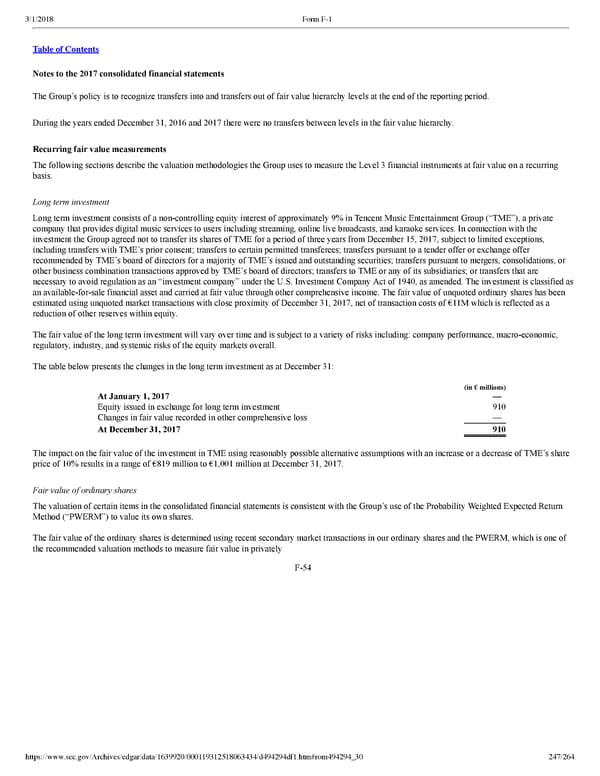

247/264 Notes to the 2017 consolidated financial statements The Group’s policy is to recognize transfers into and transfers out of fair value hierarchy levels at the end of the reporting period. During the years ended December 31, 2016 and 2017 there were no transfers between levels in the fair value hierarchy. Recurring fair value measurements The following sections describe the valuation methodologies the Group uses to measure the Level 3 financial instruments at fair value on a recurring basis. Long term investment Long term investment consists of a noncontrolling equity interest of approximately 9% in Tencent Music Entertainment Group (“TME”), a private company that provides digital music services to users including streaming, online live broadcasts, and karaoke services. In connection with the investment the Group agreed not to transfer its shares of TME for a period of three years from December 15, 2017, subject to limited exceptions, including transfers with TME’s prior consent; transfers to certain permitted transferees; transfers pursuant to a tender offer or exchange offer recommended by TME’s board of directors for a majority of TME’s issued and outstanding securities; transfers pursuant to mergers, consolidations, or other business combination transactions approved by TME’s board of directors; transfers to TME or any of its subsidiaries; or transfers that are necessary to avoid regulation as an “investment company” under the U.S. Investment Company Act of 1940, as amended. The investment is classified as an availableforsale financial asset and carried at fair value through other comprehensive income. The fair value of unquoted ordinary shares has been estimated using unquoted market transactions with close proximity of December 31, 2017, net of transaction costs of €11M which is reflected as a reduction of other reserves within equity. The fair value of the long term investment will vary over time and is subject to a variety of risks including: company performance, macroeconomic, regulatory, industry, and systemic risks of the equity markets overall. The table below presents the changes in the long term investment as at December 31: (in € millions) At January 1, 2017 — Equity issued in exchange for long term investment 910 Changes in fair value recorded in other comprehensive loss — At December 31, 2017 910 The impact on the fair value of the investment in TME using reasonably possible alternative assumptions with an increase or a decrease of TME’s share price of 10% results in a range of €819 million to €1,001 million at December 31, 2017. Fair value of ordinary shares The valuation of certain items in the consolidated financial statements is consistent with the Group’s use of the Probability Weighted Expected Return Method (“PWERM”) to value its own shares. The fair value of the ordinary shares is determined using recent secondary market transactions in our ordinary shares and the PWERM, which is one of the recommended valuation methods to measure fair value in privately F54

Spotify F1 | Interactive Prospectus Page 246 Page 248

Spotify F1 | Interactive Prospectus Page 246 Page 248