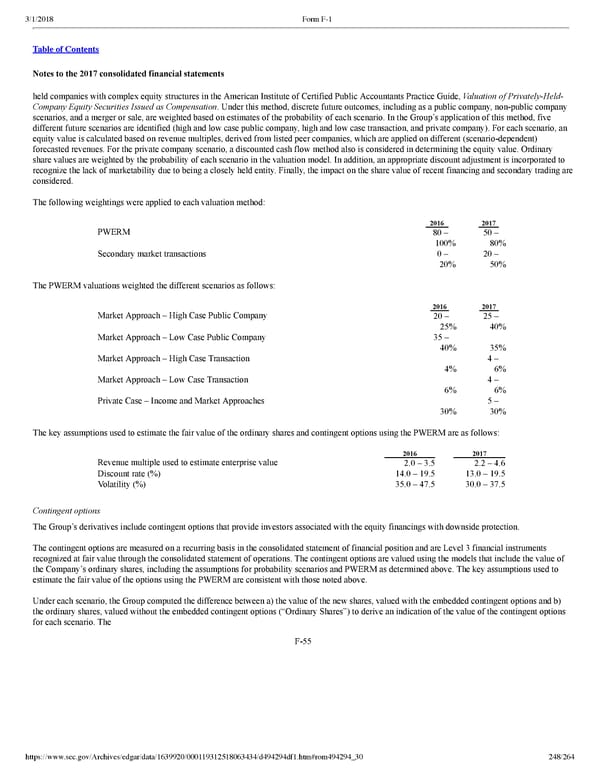

248/264 Notes to the 2017 consolidated financial statements held companies with complex equity structures in the American Institute of Certified Public Accountants Practice Guide, Valuation of PrivatelyHeld Company Equity Securities Issued as Compensation . Under this method, discrete future outcomes, including as a public company, nonpublic company scenarios, and a merger or sale, are weighted based on estimates of the probability of each scenario. In the Group’s application of this method, five different future scenarios are identified (high and low case public company, high and low case transaction, and private company). For each scenario, an equity value is calculated based on revenue multiples, derived from listed peer companies, which are applied on different (scenariodependent) forecasted revenues. For the private company scenario, a discounted cash flow method also is considered in determining the equity value. Ordinary share values are weighted by the probability of each scenario in the valuation model. In addition, an appropriate discount adjustment is incorporated to recognize the lack of marketability due to being a closely held entity. Finally, the impact on the share value of recent financing and secondary trading are considered. The following weightings were applied to each valuation method: 2016 2017 PWERM 80 – 100 % 50 – 80 % Secondary market transactions 0 – 20 % 20 – 50 % The PWERM valuations weighted the different scenarios as follows: 2016 2017 Market Approach – High Case Public Company 20 – 25 % 25 – 40 % Market Approach – Low Case Public Company 35 – 40 % 35 % Market Approach – High Case Transaction 4 % 4 – 6 % Market Approach – Low Case Transaction 6 % 4 – 6 % Private Case – Income and Market Approaches 30 % 5 – 30 % The key assumptions used to estimate the fair value of the ordinary shares and contingent options using the PWERM are as follows: 2016 2017 Revenue multiple used to estimate enterprise value 2.0 – 3.5 2.2 – 4.6 Discount rate (%) 14.0 – 19.5 13.0 – 19.5 Volatility (%) 35.0 – 47.5 30.0 – 37.5 Contingent options The Group’s derivatives include contingent options that provide investors associated with the equity financings with downside protection. The contingent options are measured on a recurring basis in the consolidated statement of financial position and are Level 3 financial instruments recognized at fair value through the consolidated statement of operations. The contingent options are valued using the models that include the value of the Company’s ordinary shares, including the assumptions for probability scenarios and PWERM as determined above. The key assumptions used to estimate the fair value of the options using the PWERM are consistent with those noted above. Under each scenario, the Group computed the difference between a) the value of the new shares, valued with the embedded contingent options and b) the ordinary shares, valued without the embedded contingent options (“Ordinary Shares”) to derive an indication of the value of the contingent options for each scenario. The F55

Spotify F1 | Interactive Prospectus Page 247 Page 249

Spotify F1 | Interactive Prospectus Page 247 Page 249