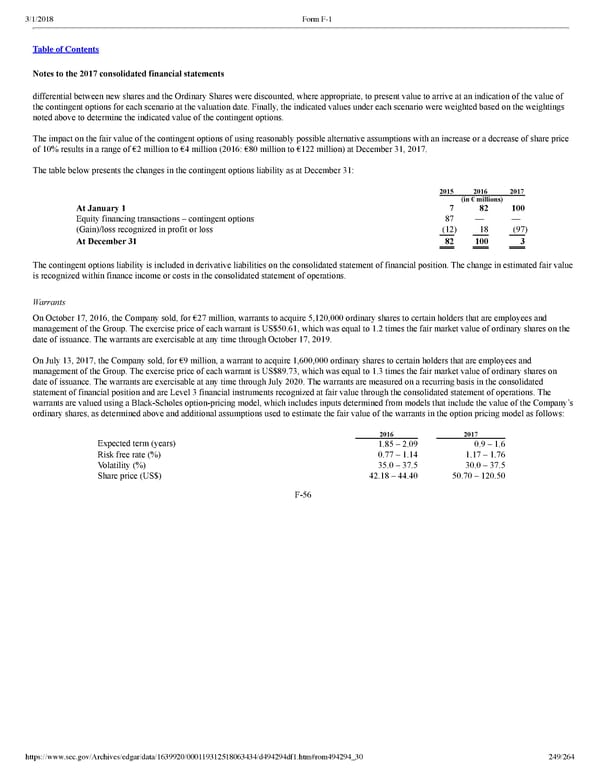

249/264 Notes to the 2017 consolidated financial statements differential between new shares and the Ordinary Shares were discounted, where appropriate, to present value to arrive at an indication of the value of the contingent options for each scenario at the valuation date. Finally, the indicated values under each scenario were weighted based on the weightings noted above to determine the indicated value of the contingent options. The impact on the fair value of the contingent options of using reasonably possible alternative assumptions with an increase or a decrease of share price of 10% results in a range of €2 million to €4 million (2016: €80 million to €122 million) at December 31, 2017. The table below presents the changes in the contingent options liability as at December 31: 2015 2016 2017 (in € millions) At January 1 7 82 100 Equity financing transactions – contingent options 87 — — (Gain)/loss recognized in profit or loss (12 ) 18 (97 ) At December 31 82 100 3 The contingent options liability is included in derivative liabilities on the consolidated statement of financial position. The change in estimated fair value is recognized within finance income or costs in the consolidated statement of operations. Warrants On October 17, 2016, the Company sold, for €27 million, warrants to acquire 5,120,000 ordinary shares to certain holders that are employees and management of the Group. The exercise price of each warrant is US$50.61, which was equal to 1.2 times the fair market value of ordinary shares on the date of issuance. The warrants are exercisable at any time through October 17, 2019. On July 13, 2017, the Company sold, for €9 million, a warrant to acquire 1,600,000 ordinary shares to certain holders that are employees and management of the Group. The exercise price of each warrant is US$89.73, which was equal to 1.3 times the fair market value of ordinary shares on date of issuance. The warrants are exercisable at any time through July 2020. The warrants are measured on a recurring basis in the consolidated statement of financial position and are Level 3 financial instruments recognized at fair value through the consolidated statement of operations. The warrants are valued using a BlackScholes optionpricing model, which includes inputs determined from models that include the value of the Company’s ordinary shares, as determined above and additional assumptions used to estimate the fair value of the warrants in the option pricing model as follows: 2016 2017 Expected term (years) 1.85 – 2.09 0.9 – 1.6 Risk free rate (%) 0.77 – 1.14 1.17 – 1.76 Volatility (%) 35.0 – 37.5 30.0 – 37.5 Share price (US$) 42.18 – 44.40 50.70 – 120.50 F56

Spotify F1 | Interactive Prospectus Page 248 Page 250

Spotify F1 | Interactive Prospectus Page 248 Page 250