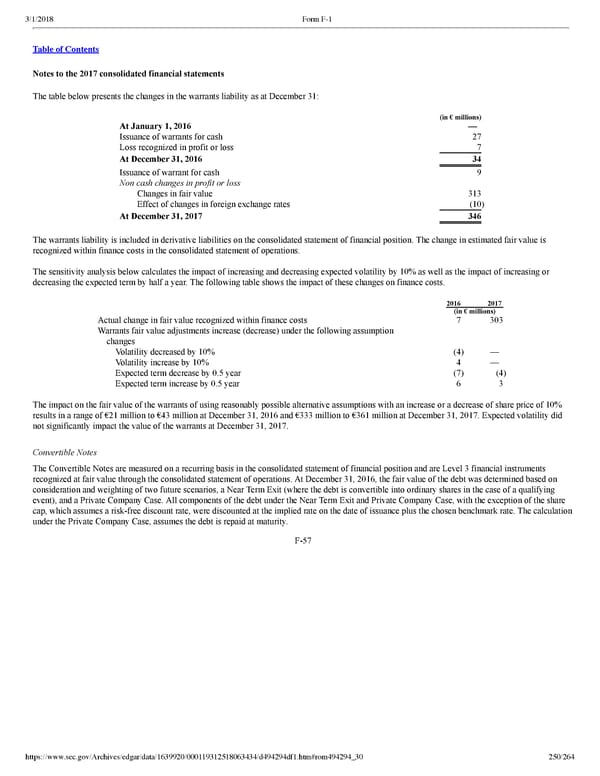

250/264 Notes to the 2017 consolidated financial statements The table below presents the changes in the warrants liability as at December 31: (in € millions) At January 1, 2016 — Issuance of warrants for cash 27 Loss recognized in profit or loss 7 At December 31, 2016 34 Issuance of warrant for cash 9 Non cash changes in profit or loss Changes in fair value 313 Effect of changes in foreign exchange rates (10 ) At December 31, 2017 346 The warrants liability is included in derivative liabilities on the consolidated statement of financial position. The change in estimated fair value is recognized within finance costs in the consolidated statement of operations. The sensitivity analysis below calculates the impact of increasing and decreasing expected volatility by 10% as well as the impact of increasing or decreasing the expected term by half a year. The following table shows the impact of these changes on finance costs. 2016 2017 (in € millions) Actual change in fair value recognized within finance costs 7 303 Warrants fair value adjustments increase (decrease) under the following assumption changes Volatility decreased by 10% (4 ) — Volatility increase by 10% 4 — Expected term decrease by 0.5 year (7 ) (4 ) Expected term increase by 0.5 year 6 3 The impact on the fair value of the warrants of using reasonably possible alternative assumptions with an increase or a decrease of share price of 10% results in a range of €21 million to €43 million at December 31, 2016 and €333 million to €361 million at December 31, 2017. Expected volatility did not significantly impact the value of the warrants at December 31, 2017. Convertible Notes The Convertible Notes are measured on a recurring basis in the consolidated statement of financial position and are Level 3 financial instruments recognized at fair value through the consolidated statement of operations. At December 31, 2016, the fair value of the debt was determined based on consideration and weighting of two future scenarios, a Near Term Exit (where the debt is convertible into ordinary shares in the case of a qualifying event), and a Private Company Case. All components of the debt under the Near Term Exit and Private Company Case, with the exception of the share cap, which assumes a riskfree discount rate, were discounted at the implied rate on the date of issuance plus the chosen benchmark rate. The calculation under the Private Company Case, assumes the debt is repaid at maturity. F57

Spotify F1 | Interactive Prospectus Page 249 Page 251

Spotify F1 | Interactive Prospectus Page 249 Page 251