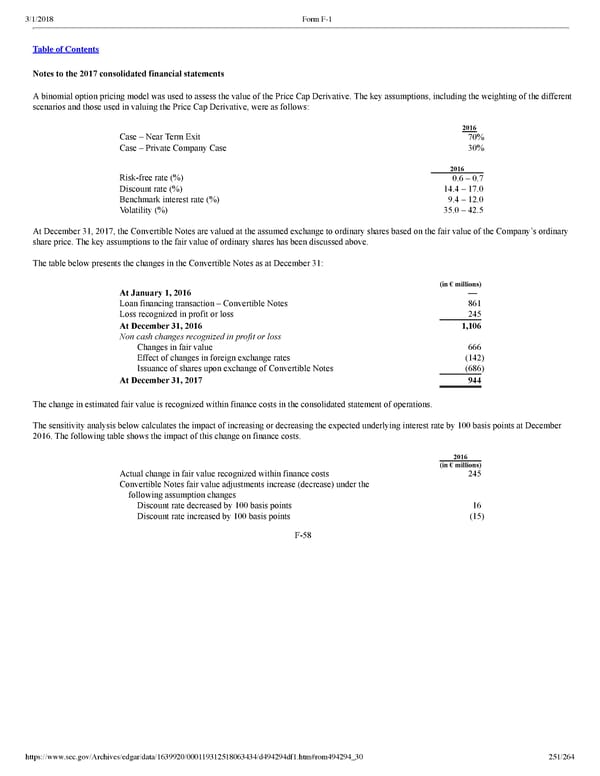

251/264 Notes to the 2017 consolidated financial statements A binomial option pricing model was used to assess the value of the Price Cap Derivative. The key assumptions, including the weighting of the different scenarios and those used in valuing the Price Cap Derivative, were as follows: 2016 Case – Near Term Exit 70 % Case – Private Company Case 30 % 2016 Riskfree rate (%) 0.6 – 0.7 Discount rate (%) 14.4 – 17.0 Benchmark interest rate (%) 9.4 – 12.0 Volatility (%) 35.0 – 42.5 At December 31, 2017, the Convertible Notes are valued at the assumed exchange to ordinary shares based on the fair value of the Company’s ordinary share price. The key assumptions to the fair value of ordinary shares has been discussed above. The table below presents the changes in the Convertible Notes as at December 31: (in € millions) At January 1, 2016 — Loan financing transaction – Convertible Notes 861 Loss recognized in profit or loss 245 At December 31, 2016 1,106 Non cash changes recognized in profit or loss Changes in fair value 666 Effect of changes in foreign exchange rates (142 ) Issuance of shares upon exchange of Convertible Notes (686 ) At December 31, 2017 944 The change in estimated fair value is recognized within finance costs in the consolidated statement of operations. The sensitivity analysis below calculates the impact of increasing or decreasing the expected underlying interest rate by 100 basis points at December 2016. The following table shows the impact of this change on finance costs. 2016 (in € millions) Actual change in fair value recognized within finance costs 245 Convertible Notes fair value adjustments increase (decrease) under the following assumption changes Discount rate decreased by 100 basis points 16 Discount rate increased by 100 basis points (15 ) F58

Spotify F1 | Interactive Prospectus Page 250 Page 252

Spotify F1 | Interactive Prospectus Page 250 Page 252