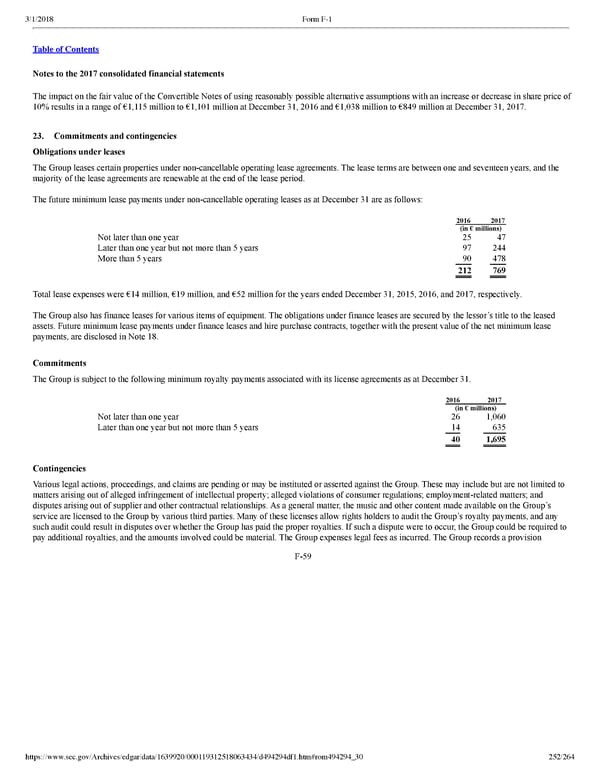

252/264 Notes to the 2017 consolidated financial statements The impact on the fair value of the Convertible Notes of using reasonably possible alternative assumptions with an increase or decrease in share price of 10% results in a range of €1,115 million to €1,101 million at December 31, 2016 and €1,038 million to €849 million at December 31, 2017. 23. Commitments and contingencies Obligations under leases The Group leases certain properties under noncancellable operating lease agreements. The lease terms are between one and seventeen years, and the majority of the lease agreements are renewable at the end of the lease period. The future minimum lease payments under noncancellable operating leases as at December 31 are as follows: 2016 2017 (in € millions) Not later than one year 25 47 Later than one year but not more than 5 years 97 244 More than 5 years 90 478 212 769 Total lease expenses were €14 million, €19 million, and €52 million for the years ended December 31, 2015, 2016, and 2017, respectively. The Group also has finance leases for various items of equipment. The obligations under finance leases are secured by the lessor’s title to the leased assets. Future minimum lease payments under finance leases and hire purchase contracts, together with the present value of the net minimum lease payments, are disclosed in Note 18. Commitments The Group is subject to the following minimum royalty payments associated with its license agreements as at December 31. 2016 2017 (in € millions) Not later than one year 26 1,060 Later than one year but not more than 5 years 14 635 40 1,695 Contingencies Various legal actions, proceedings, and claims are pending or may be instituted or asserted against the Group. These may include but are not limited to matters arising out of alleged infringement of intellectual property; alleged violations of consumer regulations; employmentrelated matters; and disputes arising out of supplier and other contractual relationships. As a general matter, the music and other content made available on the Group’s service are licensed to the Group by various third parties. Many of these licenses allow rights holders to audit the Group’s royalty payments, and any such audit could result in disputes over whether the Group has paid the proper royalties. If such a dispute were to occur, the Group could be required to pay additional royalties, and the amounts involved could be material. The Group expenses legal fees as incurred. The Group records a provision F59

Spotify F1 | Interactive Prospectus Page 251 Page 253

Spotify F1 | Interactive Prospectus Page 251 Page 253