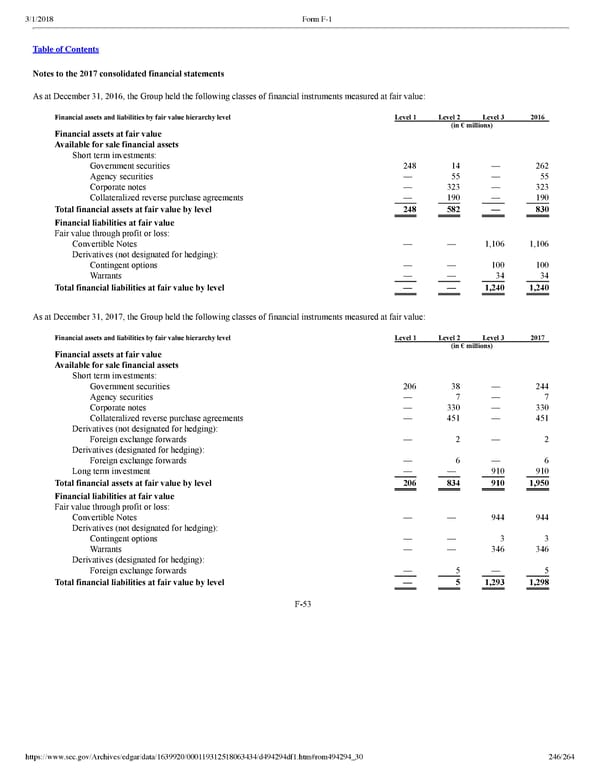

246/264 Notes to the 2017 consolidated financial statements As at December 31, 2016, the Group held the following classes of financial instruments measured at fair value: Financial assets and liabilities by fair value hierarchy level Level 1 Level 2 Level 3 2016 (in € millions) Financial assets at fair value Available for sale financial assets Short term investments: Government securities 248 14 — 262 Agency securities — 55 — 55 Corporate notes — 323 — 323 Collateralized reverse purchase agreements — 190 — 190 Total financial assets at fair value by level 248 582 — 830 Financial liabilities at fair value Fair value through profit or loss: Convertible Notes — — 1,106 1,106 Derivatives (not designated for hedging): Contingent options — — 100 100 Warrants — — 34 34 Total financial liabilities at fair value by level — — 1,240 1,240 As at December 31, 2017, the Group held the following classes of financial instruments measured at fair value: Financial assets and liabilities by fair value hierarchy level Level 1 Level 2 Level 3 2017 (in € millions) Financial assets at fair value Available for sale financial assets Short term investments: Government securities 206 38 — 244 Agency securities — 7 — 7 Corporate notes — 330 — 330 Collateralized reverse purchase agreements — 451 — 451 Derivatives (not designated for hedging): Foreign exchange forwards — 2 — 2 Derivatives (designated for hedging): Foreign exchange forwards — 6 — 6 Long term investment — — 910 910 Total financial assets at fair value by level 206 834 910 1,950 Financial liabilities at fair value Fair value through profit or loss: Convertible Notes — — 944 944 Derivatives (not designated for hedging): Contingent options — — 3 3 Warrants — — 346 346 Derivatives (designated for hedging): Foreign exchange forwards — 5 — 5 Total financial liabilities at fair value by level — 5 1,293 1,298 F53

Spotify F1 | Interactive Prospectus Page 245 Page 247

Spotify F1 | Interactive Prospectus Page 245 Page 247