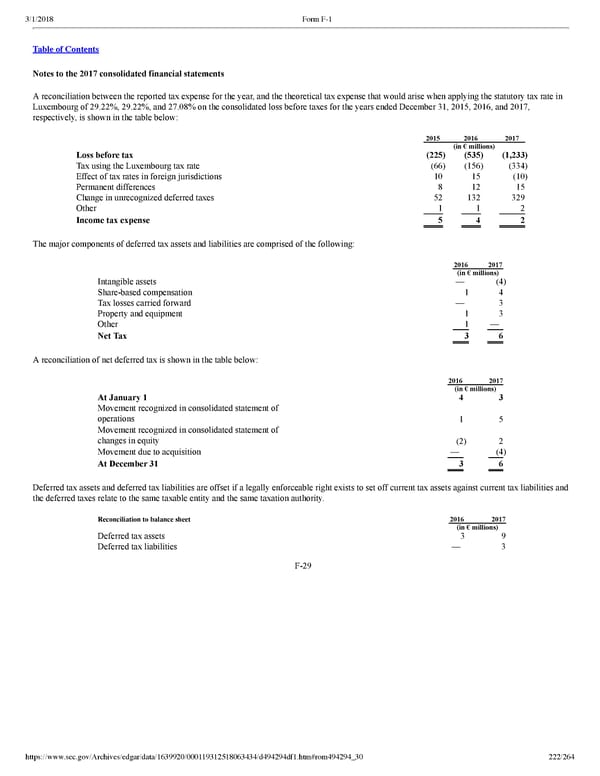

222/264 Notes to the 2017 consolidated financial statements A reconciliation between the reported tax expense for the year, and the theoretical tax expense that would arise when applying the statutory tax rate in Luxembourg of 29.22%, 29.22%, and 27.08% on the consolidated loss before taxes for the years ended December 31, 2015, 2016, and 2017, respectively, is shown in the table below: 2015 2016 2017 (in € millions) Loss before tax (225 ) (535 ) (1,233 ) Tax using the Luxembourg tax rate (66 ) (156 ) (334 ) Effect of tax rates in foreign jurisdictions 10 15 (10 ) Permanent differences 8 12 15 Change in unrecognized deferred taxes 52 132 329 Other 1 1 2 Income tax expense 5 4 2 The major components of deferred tax assets and liabilities are comprised of the following: 2016 2017 (in € millions) Intangible assets — (4 ) Sharebased compensation 1 4 Tax losses carried forward — 3 Property and equipment 1 3 Other 1 — Net Tax 3 6 A reconciliation of net deferred tax is shown in the table below: 2016 2017 (in € millions) At January 1 4 3 Movement recognized in consolidated statement of operations 1 5 Movement recognized in consolidated statement of changes in equity (2 ) 2 Movement due to acquisition — (4 ) At December 31 3 6 Deferred tax assets and deferred tax liabilities are offset if a legally enforceable right exists to set off current tax assets against current tax liabilities and the deferred taxes relate to the same taxable entity and the same taxation authority. Reconciliation to balance sheet 2016 2017 (in € millions) Deferred tax assets 3 9 Deferred tax liabilities — 3 F29

Spotify F1 | Interactive Prospectus Page 221 Page 223

Spotify F1 | Interactive Prospectus Page 221 Page 223