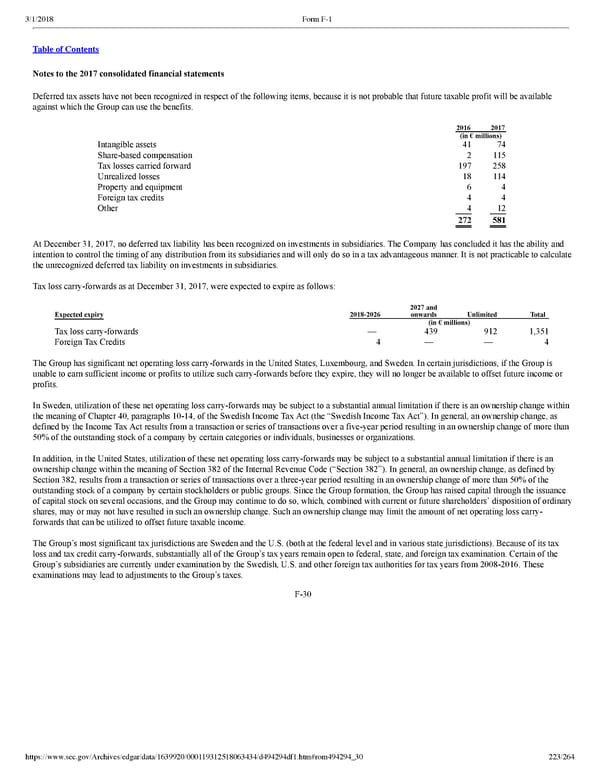

223/264 Notes to the 2017 consolidated financial statements Deferred tax assets have not been recognized in respect of the following items, because it is not probable that future taxable profit will be available against which the Group can use the benefits. 2016 2017 (in € millions) Intangible assets 41 74 Sharebased compensation 2 115 Tax losses carried forward 197 258 Unrealized losses 18 114 Property and equipment 6 4 Foreign tax credits 4 4 Other 4 12 272 581 At December 31, 2017, no deferred tax liability has been recognized on investments in subsidiaries. The Company has concluded it has the ability and intention to control the timing of any distribution from its subsidiaries and will only do so in a tax advantageous manner. It is not practicable to calculate the unrecognized deferred tax liability on investments in subsidiaries. Tax loss carryforwards as at December 31, 2017, were expected to expire as follows: Expected expiry 20182026 2027 and onwards Unlimited Total (in € millions) Tax loss carryforwards — 439 912 1,351 Foreign Tax Credits 4 — — 4 The Group has significant net operating loss carryforwards in the United States, Luxembourg, and Sweden. In certain jurisdictions, if the Group is unable to earn sufficient income or profits to utilize such carryforwards before they expire, they will no longer be available to offset future income or profits. In Sweden, utilization of these net operating loss carryforwards may be subject to a substantial annual limitation if there is an ownership change within the meaning of Chapter 40, paragraphs 1014, of the Swedish Income Tax Act (the “Swedish Income Tax Act”). In general, an ownership change, as defined by the Income Tax Act results from a transaction or series of transactions over a fiveyear period resulting in an ownership change of more than 50% of the outstanding stock of a company by certain categories or individuals, businesses or organizations. In addition, in the United States, utilization of these net operating loss carryforwards may be subject to a substantial annual limitation if there is an ownership change within the meaning of Section 382 of the Internal Revenue Code (“Section 382”). In general, an ownership change, as defined by Section 382, results from a transaction or series of transactions over a threeyear period resulting in an ownership change of more than 50% of the outstanding stock of a company by certain stockholders or public groups. Since the Group formation, the Group has raised capital through the issuance of capital stock on several occasions, and the Group may continue to do so, which, combined with current or future shareholders’ disposition of ordinary shares, may or may not have resulted in such an ownership change. Such an ownership change may limit the amount of net operating loss carry forwards that can be utilized to offset future taxable income. The Group’s most significant tax jurisdictions are Sweden and the U.S. (both at the federal level and in various state jurisdictions). Because of its tax loss and tax credit carryforwards, substantially all of the Group’s tax years remain open to federal, state, and foreign tax examination. Certain of the Group’s subsidiaries are currently under examination by the Swedish, U.S. and other foreign tax authorities for tax years from 20082016. These examinations may lead to adjustments to the Group’s taxes. F30

Spotify F1 | Interactive Prospectus Page 222 Page 224

Spotify F1 | Interactive Prospectus Page 222 Page 224