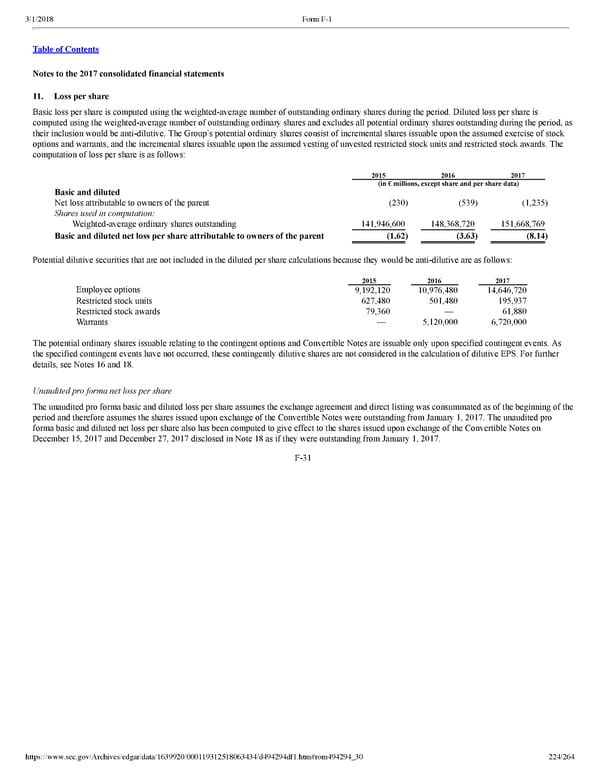

224/264 Notes to the 2017 consolidated financial statements 11. Loss per share Basic loss per share is computed using the weightedaverage number of outstanding ordinary shares during the period. Diluted loss per share is computed using the weightedaverage number of outstanding ordinary shares and excludes all potential ordinary shares outstanding during the period, as their inclusion would be antidilutive. The Group’s potential ordinary shares consist of incremental shares issuable upon the assumed exercise of stock options and warrants, and the incremental shares issuable upon the assumed vesting of unvested restricted stock units and restricted stock awards. The computation of loss per share is as follows: 2015 2016 2017 (in € millions, except share and per share data) Basic and diluted Net loss attributable to owners of the parent (230 ) (539 ) (1,235 ) Shares used in computation: Weightedaverage ordinary shares outstanding 141,946,600 148,368,720 151,668,769 Basic and diluted net loss per share attributable to owners of the parent (1.62 ) (3.63 ) (8.14 ) Potential dilutive securities that are not included in the diluted per share calculations because they would be antidilutive are as follows: 2015 2016 2017 Employee options 9,192,120 10,976,480 14,646,720 Restricted stock units 627,480 501,480 195,937 Restricted stock awards 79,360 — 61,880 Warrants — 5,120,000 6,720,000 The potential ordinary shares issuable relating to the contingent options and Convertible Notes are issuable only upon specified contingent events. As the specified contingent events have not occurred, these contingently dilutive shares are not considered in the calculation of dilutive EPS. For further details, see Notes 16 and 18. Unaudited pro forma net loss per share The unaudited pro forma basic and diluted loss per share assumes the exchange agreement and direct listing was consummated as of the beginning of the period and therefore assumes the shares issued upon exchange of the Convertible Notes were outstanding from January 1, 2017. The unaudited pro forma basic and diluted net loss per share also has been computed to give effect to the shares issued upon exchange of the Convertible Notes on December 15, 2017 and December 27, 2017 disclosed in Note 18 as if they were outstanding from January 1, 2017. F31

Spotify F1 | Interactive Prospectus Page 223 Page 225

Spotify F1 | Interactive Prospectus Page 223 Page 225