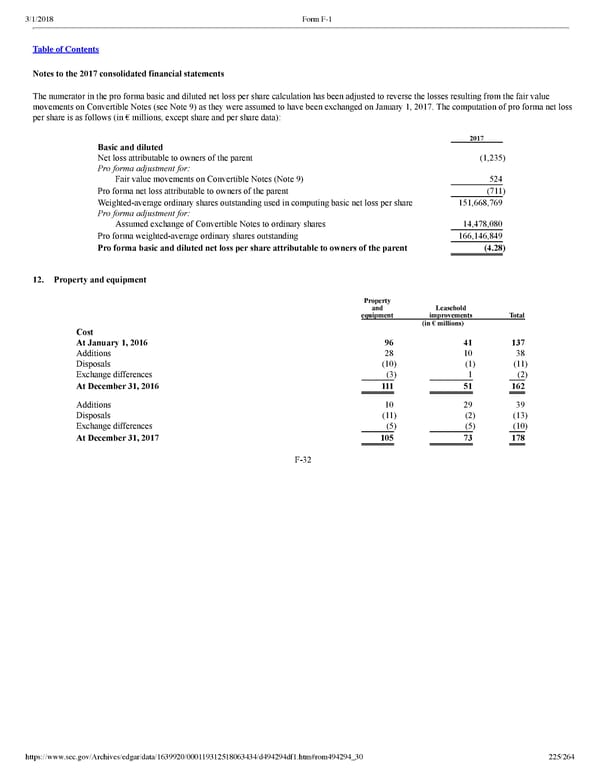

225/264 Notes to the 2017 consolidated financial statements The numerator in the pro forma basic and diluted net loss per share calculation has been adjusted to reverse the losses resulting from the fair value movements on Convertible Notes (see Note 9) as they were assumed to have been exchanged on January 1, 2017. The computation of pro forma net loss per share is as follows (in € millions, except share and per share data): 2017 Basic and diluted Net loss attributable to owners of the parent (1,235 ) Pro forma adjustment for: Fair value movements on Convertible Notes (Note 9) 524 Pro forma net loss attributable to owners of the parent (711 ) Weightedaverage ordinary shares outstanding used in computing basic net loss per share 151,668,769 Pro forma adjustment for: Assumed exchange of Convertible Notes to ordinary shares 14,478,080 Pro forma weightedaverage ordinary shares outstanding 166,146,849 Pro forma basic and diluted net loss per share attributable to owners of the parent (4.28 ) 12. Property and equipment Property and equipment Leasehold improvements Total (in € millions) Cost At January 1, 2016 96 41 137 Additions 28 10 38 Disposals (10 ) (1 ) (11 ) Exchange differences (3 ) 1 (2 ) At December 31, 2016 111 51 162 Additions 10 29 39 Disposals (11 ) (2 ) (13 ) Exchange differences (5 ) (5 ) (10 ) At December 31, 2017 105 73 178 F32

Spotify F1 | Interactive Prospectus Page 224 Page 226

Spotify F1 | Interactive Prospectus Page 224 Page 226