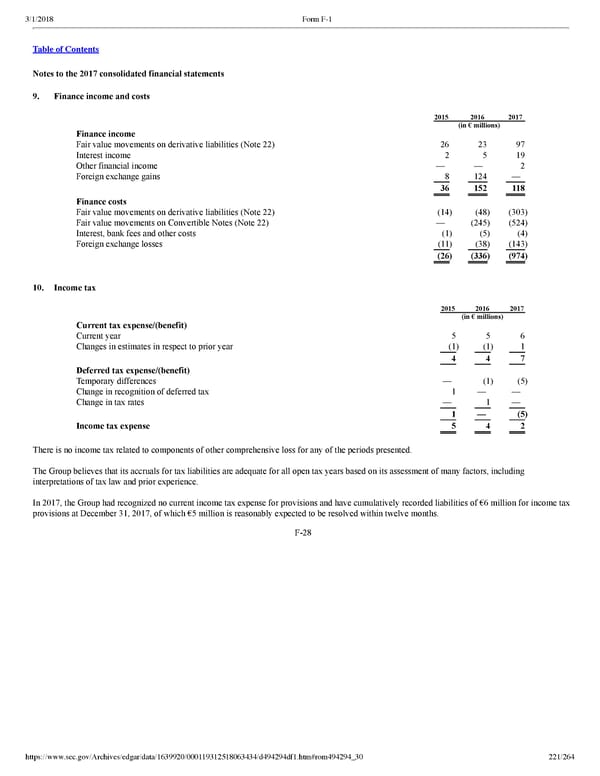

221/264 Notes to the 2017 consolidated financial statements 9. Finance income and costs 2015 2016 2017 (in € millions) Finance income Fair value movements on derivative liabilities (Note 22) 26 23 97 Interest income 2 5 19 Other financial income — — 2 Foreign exchange gains 8 124 — 36 152 118 Finance costs Fair value movements on derivative liabilities (Note 22) (14 ) (48 ) (303 ) Fair value movements on Convertible Notes (Note 22) — (245 ) (524 ) Interest, bank fees and other costs (1 ) (5 ) (4 ) Foreign exchange losses (11 ) (38 ) (143 ) (26 ) (336 ) (974 ) 10. Income tax 2015 2016 2017 (in € millions) Current tax expense/(benefit) Current year 5 5 6 Changes in estimates in respect to prior year (1 ) (1 ) 1 4 4 7 Deferred tax expense/(benefit) Temporary differences — (1 ) (5 ) Change in recognition of deferred tax 1 — — Change in tax rates — 1 — 1 — (5 ) Income tax expense 5 4 2 There is no income tax related to components of other comprehensive loss for any of the periods presented. The Group believes that its accruals for tax liabilities are adequate for all open tax years based on its assessment of many factors, including interpretations of tax law and prior experience. In 2017, the Group had recognized no current income tax expense for provisions and have cumulatively recorded liabilities of €6 million for income tax provisions at December 31, 2017, of which €5 million is reasonably expected to be resolved within twelve months. F28

Spotify F1 | Interactive Prospectus Page 220 Page 222

Spotify F1 | Interactive Prospectus Page 220 Page 222