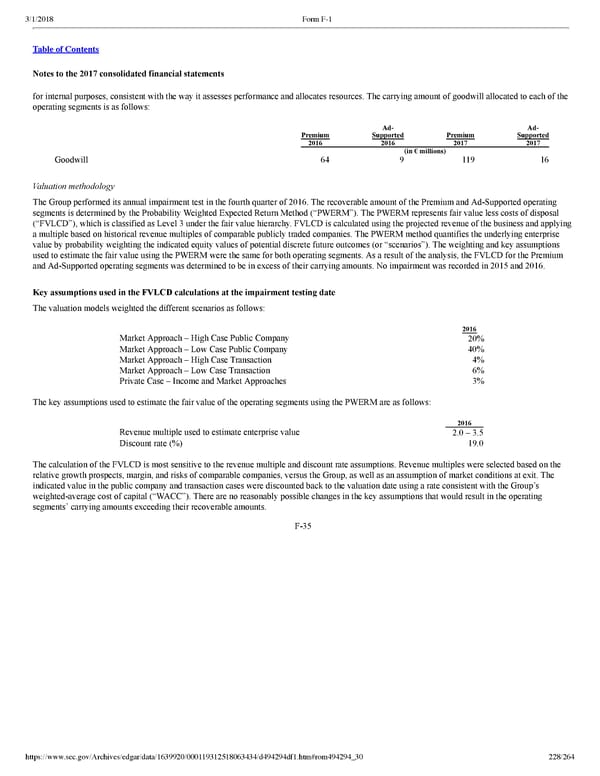

228/264 Notes to the 2017 consolidated financial statements for internal purposes, consistent with the way it assesses performance and allocates resources. The carrying amount of goodwill allocated to each of the operating segments is as follows: Premium Ad Supported Premium Ad Supported 2016 2016 2017 2017 (in € millions) Goodwill 64 9 119 16 Valuation methodology The Group performed its annual impairment test in the fourth quarter of 2016. The recoverable amount of the Premium and AdSupported operating segments is determined by the Probability Weighted Expected Return Method (“PWERM”). The PWERM represents fair value less costs of disposal (“FVLCD”), which is classified as Level 3 under the fair value hierarchy. FVLCD is calculated using the projected revenue of the business and applying a multiple based on historical revenue multiples of comparable publicly traded companies. The PWERM method quantifies the underlying enterprise value by probability weighting the indicated equity values of potential discrete future outcomes (or “scenarios”). The weighting and key assumptions used to estimate the fair value using the PWERM were the same for both operating segments. As a result of the analysis, the FVLCD for the Premium and AdSupported operating segments was determined to be in excess of their carrying amounts. No impairment was recorded in 2015 and 2016. Key assumptions used in the FVLCD calculations at the impairment testing date The valuation models weighted the different scenarios as follows: 2016 Market Approach – High Case Public Company 20 % Market Approach – Low Case Public Company 40 % Market Approach – High Case Transaction 4 % Market Approach – Low Case Transaction 6 % Private Case – Income and Market Approaches 3 % The key assumptions used to estimate the fair value of the operating segments using the PWERM are as follows: 2016 Revenue multiple used to estimate enterprise value 2.0 – 3.5 Discount rate (%) 19.0 The calculation of the FVLCD is most sensitive to the revenue multiple and discount rate assumptions. Revenue multiples were selected based on the relative growth prospects, margin, and risks of comparable companies, versus the Group, as well as an assumption of market conditions at exit. The indicated value in the public company and transaction cases were discounted back to the valuation date using a rate consistent with the Group’s weightedaverage cost of capital (“WACC”). There are no reasonably possible changes in the key assumptions that would result in the operating segments’ carrying amounts exceeding their recoverable amounts. F35

Spotify F1 | Interactive Prospectus Page 227 Page 229

Spotify F1 | Interactive Prospectus Page 227 Page 229