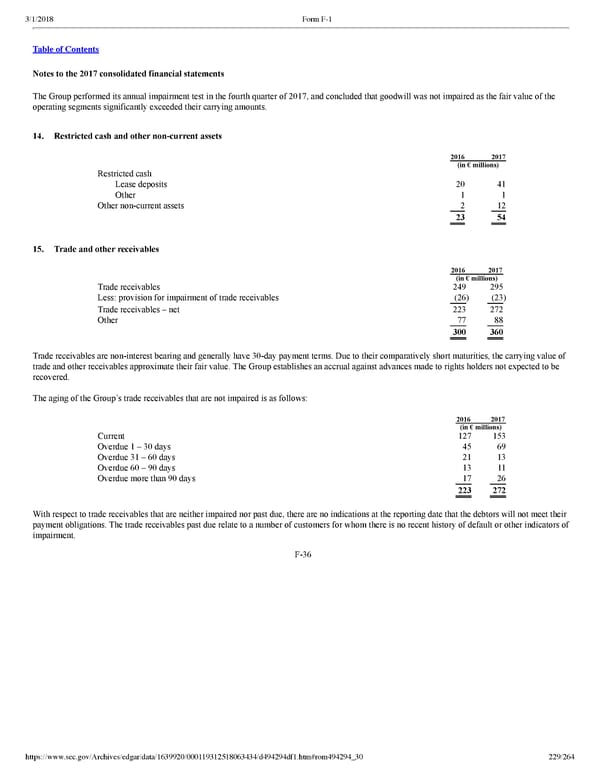

229/264 Notes to the 2017 consolidated financial statements The Group performed its annual impairment test in the fourth quarter of 2017, and concluded that goodwill was not impaired as the fair value of the operating segments significantly exceeded their carrying amounts. 14. Restricted cash and other noncurrent assets 2016 2017 (in € millions) Restricted cash Lease deposits 20 41 Other 1 1 Other noncurrent assets 2 12 23 54 15. Trade and other receivables 2016 2017 (in € millions) Trade receivables 249 295 Less: provision for impairment of trade receivables (26 ) (23 ) Trade receivables – net 223 272 Other 77 88 300 360 Trade receivables are noninterest bearing and generally have 30day payment terms. Due to their comparatively short maturities, the carrying value of trade and other receivables approximate their fair value. The Group establishes an accrual against advances made to rights holders not expected to be recovered. The aging of the Group’s trade receivables that are not impaired is as follows: 2016 2017 (in € millions) Current 127 153 Overdue 1 – 30 days 45 69 Overdue 31 – 60 days 21 13 Overdue 60 – 90 days 13 11 Overdue more than 90 days 17 26 223 272 With respect to trade receivables that are neither impaired nor past due, there are no indications at the reporting date that the debtors will not meet their payment obligations. The trade receivables past due relate to a number of customers for whom there is no recent history of default or other indicators of impairment. F36

Spotify F1 | Interactive Prospectus Page 228 Page 230

Spotify F1 | Interactive Prospectus Page 228 Page 230