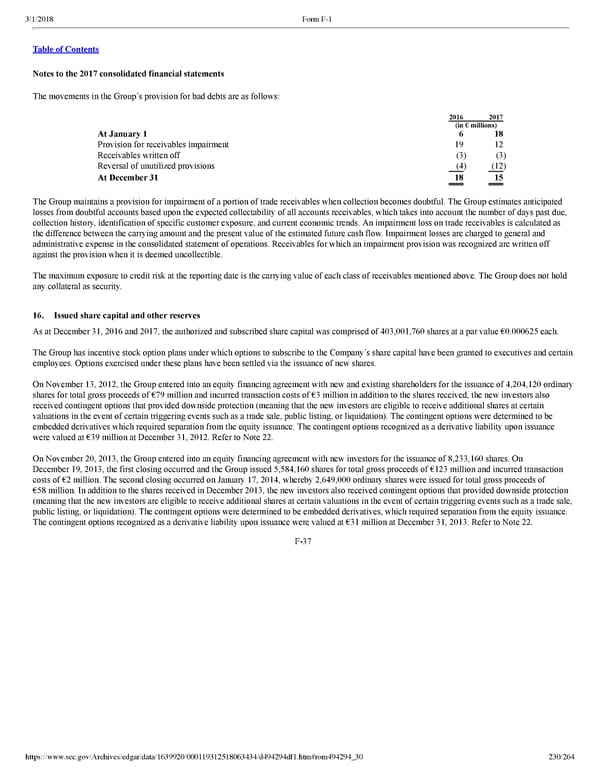

230/264 Notes to the 2017 consolidated financial statements The movements in the Group’s provision for bad debts are as follows: 2016 2017 (in € millions) At January 1 6 18 Provision for receivables impairment 19 12 Receivables written off (3 ) (3 ) Reversal of unutilized provisions (4 ) (12 ) At December 31 18 15 The Group maintains a provision for impairment of a portion of trade receivables when collection becomes doubtful. The Group estimates anticipated losses from doubtful accounts based upon the expected collectability of all accounts receivables, which takes into account the number of days past due, collection history, identification of specific customer exposure, and current economic trends. An impairment loss on trade receivables is calculated as the difference between the carrying amount and the present value of the estimated future cash flow. Impairment losses are charged to general and administrative expense in the consolidated statement of operations. Receivables for which an impairment provision was recognized are written off against the provision when it is deemed uncollectible. The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivables mentioned above. The Group does not hold any collateral as security. 16. Issued share capital and other reserves As at December 31, 2016 and 2017, the authorized and subscribed share capital was comprised of 403,001,760 shares at a par value €0.000625 each. The Group has incentive stock option plans under which options to subscribe to the Company’s share capital have been granted to executives and certain employees. Options exercised under these plans have been settled via the issuance of new shares. On November 13, 2012, the Group entered into an equity financing agreement with new and existing shareholders for the issuance of 4,204,120 ordinary shares for total gross proceeds of €79 million and incurred transaction costs of €3 million in addition to the shares received, the new investors also received contingent options that provided downside protection (meaning that the new investors are eligible to receive additional shares at certain valuations in the event of certain triggering events such as a trade sale, public listing, or liquidation). The contingent options were determined to be embedded derivatives which required separation from the equity issuance. The contingent options recognized as a derivative liability upon issuance were valued at €39 million at December 31, 2012. Refer to Note 22. On November 20, 2013, the Group entered into an equity financing agreement with new investors for the issuance of 8,233,160 shares. On December 19, 2013, the first closing occurred and the Group issued 5,584,160 shares for total gross proceeds of €123 million and incurred transaction costs of €2 million. The second closing occurred on January 17, 2014, whereby 2,649,000 ordinary shares were issued for total gross proceeds of €58 million. In addition to the shares received in December 2013, the new investors also received contingent options that provided downside protection (meaning that the new investors are eligible to receive additional shares at certain valuations in the event of certain triggering events such as a trade sale, public listing, or liquidation). The contingent options were determined to be embedded derivatives, which required separation from the equity issuance. The contingent options recognized as a derivative liability upon issuance were valued at €31 million at December 31, 2013. Refer to Note 22. F37

Spotify F1 | Interactive Prospectus Page 229 Page 231

Spotify F1 | Interactive Prospectus Page 229 Page 231