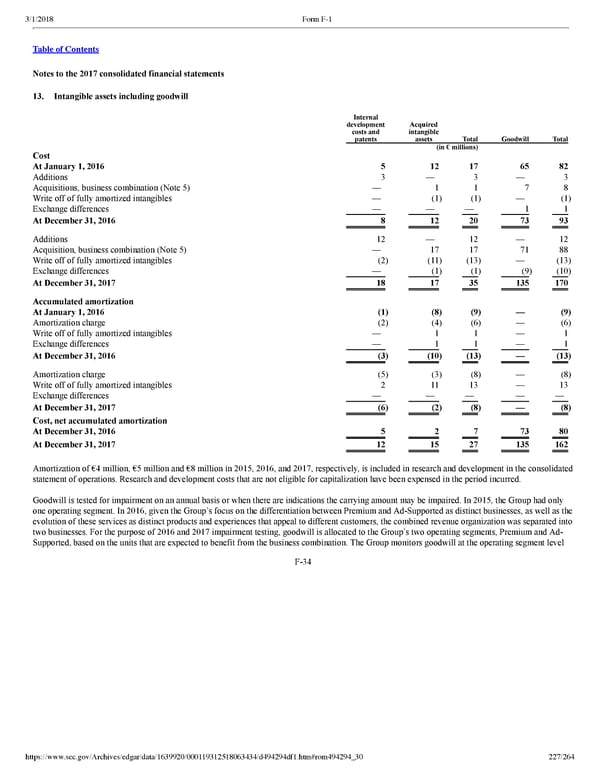

227/264 Notes to the 2017 consolidated financial statements 13. Intangible assets including goodwill Internal development costs and patents Acquired intangible assets Total Goodwill Total (in € millions) Cost At January 1, 2016 5 12 17 65 82 Additions 3 — 3 — 3 Acquisitions, business combination (Note 5) — 1 1 7 8 Write off of fully amortized intangibles — (1 ) (1 ) — (1 ) Exchange differences — — — 1 1 At December 31, 2016 8 12 20 73 93 Additions 12 — 12 — 12 Acquisition, business combination (Note 5) — 17 17 71 88 Write off of fully amortized intangibles (2 ) (11 ) (13 ) — (13 ) Exchange differences — (1 ) (1 ) (9 ) (10 ) At December 31, 2017 18 17 35 135 170 Accumulated amortization At January 1, 2016 (1 ) (8 ) (9 ) — (9 ) Amortization charge (2 ) (4 ) (6 ) — (6 ) Write off of fully amortized intangibles — 1 1 — 1 Exchange differences — 1 1 — 1 At December 31, 2016 (3 ) (10 ) (13 ) — (13 ) Amortization charge (5 ) (3 ) (8 ) — (8 ) Write off of fully amortized intangibles 2 11 13 — 13 Exchange differences — — — — — At December 31, 2017 (6 ) (2 ) (8 ) — (8 ) Cost, net accumulated amortization At December 31, 2016 5 2 7 73 80 At December 31, 2017 12 15 27 135 162 Amortization of €4 million, €5 million and €8 million in 2015, 2016, and 2017, respectively, is included in research and development in the consolidated statement of operations. Research and development costs that are not eligible for capitalization have been expensed in the period incurred. Goodwill is tested for impairment on an annual basis or when there are indications the carrying amount may be impaired. In 2015, the Group had only one operating segment. In 2016, given the Group’s focus on the differentiation between Premium and AdSupported as distinct businesses, as well as the evolution of these services as distinct products and experiences that appeal to different customers, the combined revenue organization was separated into two businesses. For the purpose of 2016 and 2017 impairment testing, goodwill is allocated to the Group’s two operating segments, Premium and Ad Supported, based on the units that are expected to benefit from the business combination. The Group monitors goodwill at the operating segment level F34

Spotify F1 | Interactive Prospectus Page 226 Page 228

Spotify F1 | Interactive Prospectus Page 226 Page 228