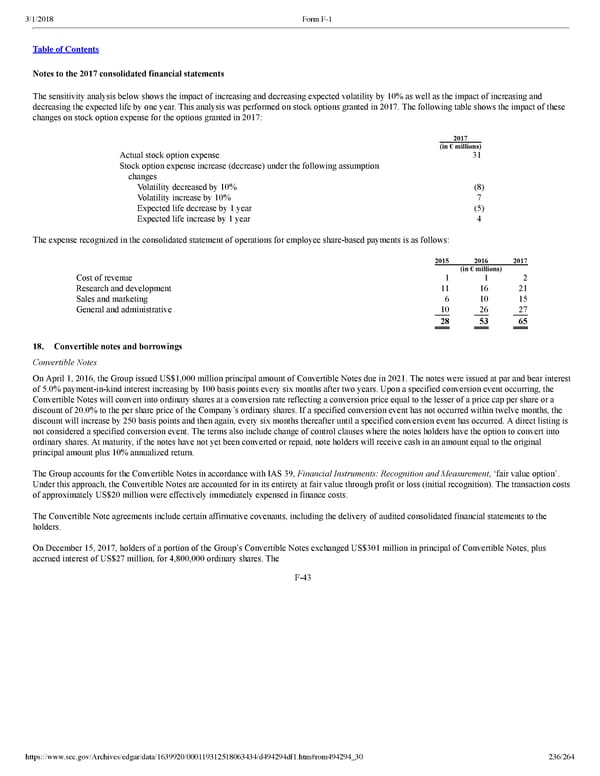

236/264 Notes to the 2017 consolidated financial statements The sensitivity analysis below shows the impact of increasing and decreasing expected volatility by 10% as well as the impact of increasing and decreasing the expected life by one year. This analysis was performed on stock options granted in 2017. The following table shows the impact of these changes on stock option expense for the options granted in 2017: 2017 (in € millions) Actual stock option expense 31 Stock option expense increase (decrease) under the following assumption changes Volatility decreased by 10% (8 ) Volatility increase by 10% 7 Expected life decrease by 1 year (5 ) Expected life increase by 1 year 4 The expense recognized in the consolidated statement of operations for employee sharebased payments is as follows: 2015 2016 2017 (in € millions) Cost of revenue 1 1 2 Research and development 11 16 21 Sales and marketing 6 10 15 General and administrative 10 26 27 28 53 65 18. Convertible notes and borrowings Convertible Notes On April 1, 2016, the Group issued US$1,000 million principal amount of Convertible Notes due in 2021. The notes were issued at par and bear interest of 5.0% paymentinkind interest increasing by 100 basis points every six months after two years. Upon a specified conversion event occurring, the Convertible Notes will convert into ordinary shares at a conversion rate reflecting a conversion price equal to the lesser of a price cap per share or a discount of 20.0% to the per share price of the Company’s ordinary shares. If a specified conversion event has not occurred within twelve months, the discount will increase by 250 basis points and then again, every six months thereafter until a specified conversion event has occurred. A direct listing is not considered a specified conversion event. The terms also include change of control clauses where the notes holders have the option to convert into ordinary shares. At maturity, if the notes have not yet been converted or repaid, note holders will receive cash in an amount equal to the original principal amount plus 10% annualized return. The Group accounts for the Convertible Notes in accordance with IAS 39, Financial Instruments: Recognition and Measurement , ‘fair value option’. Under this approach, the Convertible Notes are accounted for in its entirety at fair value through profit or loss (initial recognition). The transaction costs of approximately US$20 million were effectively immediately expensed in finance costs. The Convertible Note agreements include certain affirmative covenants, including the delivery of audited consolidated financial statements to the holders. On December 15, 2017, holders of a portion of the Group’s Convertible Notes exchanged US$301 million in principal of Convertible Notes, plus accrued interest of US$27 million, for 4,800,000 ordinary shares. The F43

Spotify F1 | Interactive Prospectus Page 235 Page 237

Spotify F1 | Interactive Prospectus Page 235 Page 237