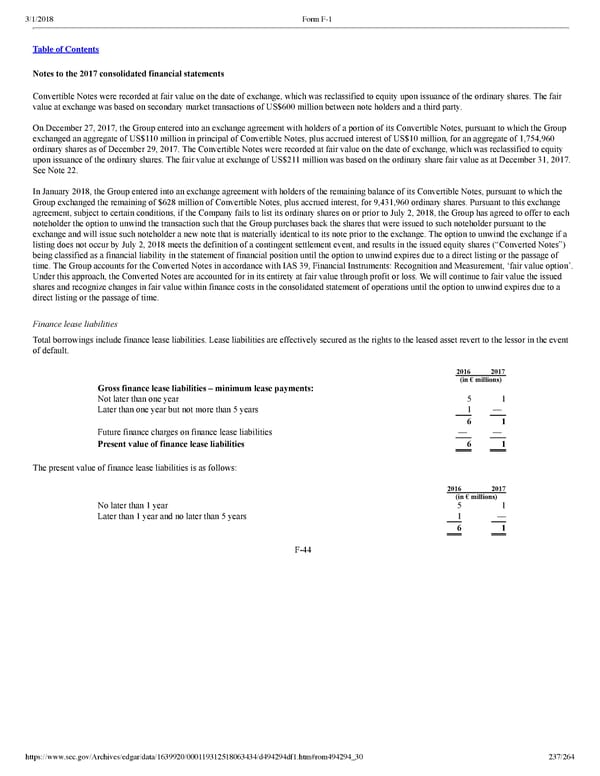

237/264 Notes to the 2017 consolidated financial statements Convertible Notes were recorded at fair value on the date of exchange, which was reclassified to equity upon issuance of the ordinary shares. The fair value at exchange was based on secondary market transactions of US$600 million between note holders and a third party. On December 27, 2017, the Group entered into an exchange agreement with holders of a portion of its Convertible Notes, pursuant to which the Group exchanged an aggregate of US$110 million in principal of Convertible Notes, plus accrued interest of US$10 million, for an aggregate of 1,754,960 ordinary shares as of December 29, 2017. The Convertible Notes were recorded at fair value on the date of exchange, which was reclassified to equity upon issuance of the ordinary shares. The fair value at exchange of US$211 million was based on the ordinary share fair value as at December 31, 2017. See Note 22. In January 2018, the Group entered into an exchange agreement with holders of the remaining balance of its Convertible Notes, pursuant to which the Group exchanged the remaining of $628 million of Convertible Notes, plus accrued interest, for 9,431,960 ordinary shares. Pursuant to this exchange agreement, subject to certain conditions, if the Company fails to list its ordinary shares on or prior to July 2, 2018, the Group has agreed to offer to each noteholder the option to unwind the transaction such that the Group purchases back the shares that were issued to such noteholder pursuant to the exchange and will issue such noteholder a new note that is materially identical to its note prior to the exchange. The option to unwind the exchange if a listing does not occur by July 2, 2018 meets the definition of a contingent settlement event, and results in the issued equity shares (“Converted Notes”) being classified as a financial liability in the statement of financial position until the option to unwind expires due to a direct listing or the passage of time. The Group accounts for the Converted Notes in accordance with IAS 39, Financial Instruments: Recognition and Measurement, ‘fair value option’. Under this approach, the Converted Notes are accounted for in its entirety at fair value through profit or loss. We will continue to fair value the issued shares and recognize changes in fair value within finance costs in the consolidated statement of operations until the option to unwind expires due to a direct listing or the passage of time. Finance lease liabilities Total borrowings include finance lease liabilities. Lease liabilities are effectively secured as the rights to the leased asset revert to the lessor in the event of default. 2016 2017 (in € millions) Gross finance lease liabilities – minimum lease payments: Not later than one year 5 1 Later than one year but not more than 5 years 1 — 6 1 Future finance charges on finance lease liabilities — — Present value of finance lease liabilities 6 1 The present value of finance lease liabilities is as follows: 2016 2017 (in € millions) No later than 1 year 5 1 Later than 1 year and no later than 5 years 1 — 6 1 F44

Spotify F1 | Interactive Prospectus Page 236 Page 238

Spotify F1 | Interactive Prospectus Page 236 Page 238