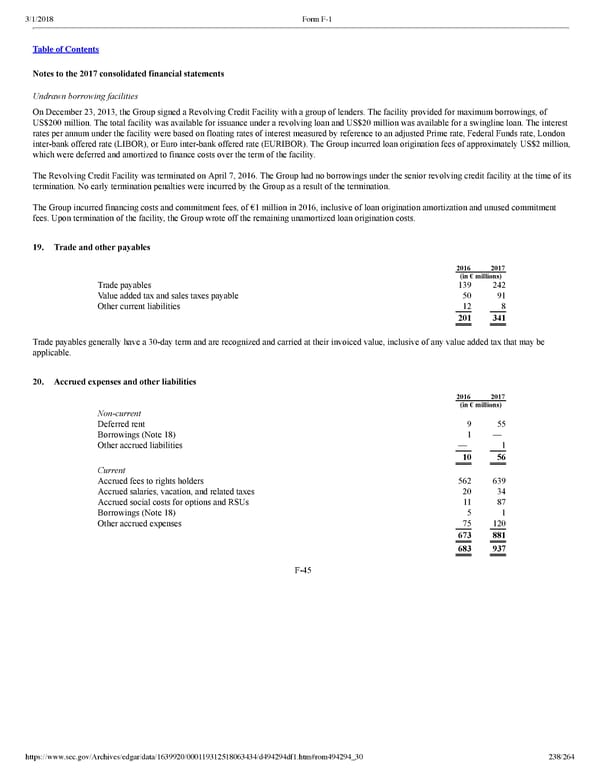

238/264 Notes to the 2017 consolidated financial statements Undrawn borrowing facilities On December 23, 2013, the Group signed a Revolving Credit Facility with a group of lenders. The facility provided for maximum borrowings, of US$200 million. The total facility was available for issuance under a revolving loan and US$20 million was available for a swingline loan. The interest rates per annum under the facility were based on floating rates of interest measured by reference to an adjusted Prime rate, Federal Funds rate, London interbank offered rate (LIBOR), or Euro interbank offered rate (EURIBOR). The Group incurred loan origination fees of approximately US$2 million, which were deferred and amortized to finance costs over the term of the facility. The Revolving Credit Facility was terminated on April 7, 2016. The Group had no borrowings under the senior revolving credit facility at the time of its termination. No early termination penalties were incurred by the Group as a result of the termination. The Group incurred financing costs and commitment fees, of €1 million in 2016, inclusive of loan origination amortization and unused commitment fees. Upon termination of the facility, the Group wrote off the remaining unamortized loan origination costs. 19. Trade and other payables 2016 2017 (in € millions) Trade payables 139 242 Value added tax and sales taxes payable 50 91 Other current liabilities 12 8 201 341 Trade payables generally have a 30day term and are recognized and carried at their invoiced value, inclusive of any value added tax that may be applicable. 20. Accrued expenses and other liabilities 2016 2017 (in € millions) Noncurrent Deferred rent 9 55 Borrowings (Note 18) 1 — Other accrued liabilities — 1 10 56 Current Accrued fees to rights holders 562 639 Accrued salaries, vacation, and related taxes 20 34 Accrued social costs for options and RSUs 11 87 Borrowings (Note 18) 5 1 Other accrued expenses 75 120 673 881 683 937 F45

Spotify F1 | Interactive Prospectus Page 237 Page 239

Spotify F1 | Interactive Prospectus Page 237 Page 239