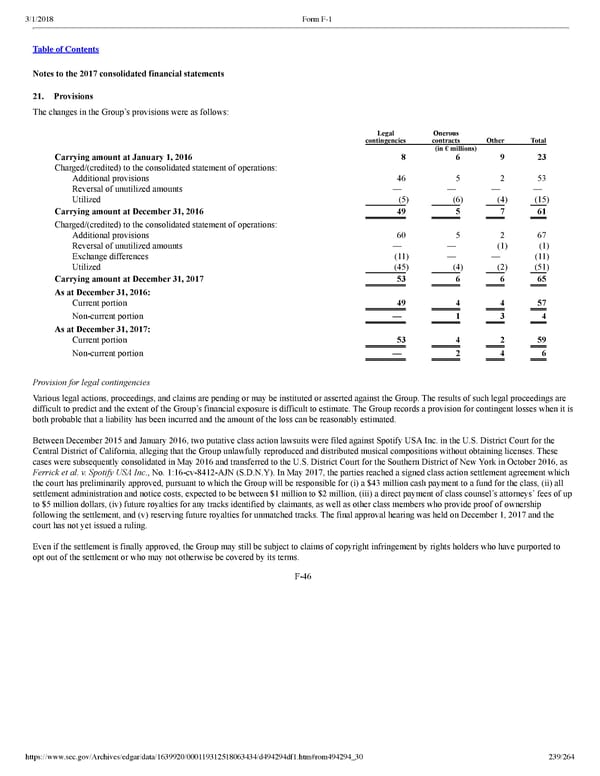

239/264 Notes to the 2017 consolidated financial statements 21. Provisions The changes in the Group’s provisions were as follows: Legal contingencies Onerous contracts Other Total (in € millions) Carrying amount at January 1, 2016 8 6 9 23 Charged/(credited) to the consolidated statement of operations: Additional provisions 46 5 2 53 Reversal of unutilized amounts — — — — Utilized (5 ) (6 ) (4 ) (15 ) Carrying amount at December 31, 2016 49 5 7 61 Charged/(credited) to the consolidated statement of operations: Additional provisions 60 5 2 67 Reversal of unutilized amounts — — (1 ) (1 ) Exchange differences (11 ) — — (11 ) Utilized (45 ) (4 ) (2 ) (51 ) Carrying amount at December 31, 2017 53 6 6 65 As at December 31, 2016: Current portion 49 4 4 57 Noncurrent portion — 1 3 4 As at December 31, 2017: Current portion 53 4 2 59 Noncurrent portion — 2 4 6 Provision for legal contingencies Various legal actions, proceedings, and claims are pending or may be instituted or asserted against the Group. The results of such legal proceedings are difficult to predict and the extent of the Group’s financial exposure is difficult to estimate. The Group records a provision for contingent losses when it is both probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Between December 2015 and January 2016, two putative class action lawsuits were filed against Spotify USA Inc. in the U.S. District Court for the Central District of California, alleging that the Group unlawfully reproduced and distributed musical compositions without obtaining licenses. These cases were subsequently consolidated in May 2016 and transferred to the U.S. District Court for the Southern District of New York in October 2016, as Ferrick et al. v. Spotify USA Inc ., No . 1:16cv8412AJN (S.D.N.Y). In May 2017, the parties reached a signed class action settlement agreement which the court has preliminarily approved, pursuant to which the Group will be responsible for (i) a $43 million cash payment to a fund for the class, (ii) all settlement administration and notice costs, expected to be between $1 million to $2 million, (iii) a direct payment of class counsel’s attorneys’ fees of up to $5 million dollars, (iv) future royalties for any tracks identified by claimants, as well as other class members who provide proof of ownership following the settlement, and (v) reserving future royalties for unmatched tracks. The final approval hearing was held on December 1, 2017 and the court has not yet issued a ruling. Even if the settlement is finally approved, the Group may still be subject to claims of copyright infringement by rights holders who have purported to opt out of the settlement or who may not otherwise be covered by its terms. F46

Spotify F1 | Interactive Prospectus Page 238 Page 240

Spotify F1 | Interactive Prospectus Page 238 Page 240