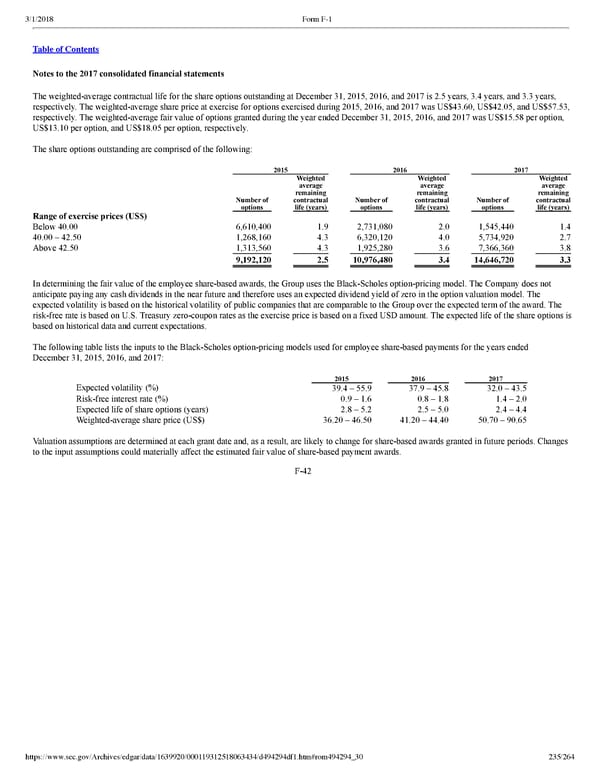

235/264 Notes to the 2017 consolidated financial statements The weightedaverage contractual life for the share options outstanding at December 31, 2015, 2016, and 2017 is 2.5 years, 3.4 years, and 3.3 years, respectively. The weightedaverage share price at exercise for options exercised during 2015, 2016, and 2017 was US$43.60, US$42.05, and US$57.53, respectively. The weightedaverage fair value of options granted during the year ended December 31, 2015, 2016, and 2017 was US$15.58 per option, US$13.10 per option, and US$18.05 per option, respectively. The share options outstanding are comprised of the following: 2015 2016 2017 Number of options Weighted average remaining contractual life (years) Number of options Weighted average remaining contractual life (years) Number of options Weighted average remaining contractual life (years) Range of exercise prices (US$) Below 40.00 6,610,400 1.9 2,731,080 2.0 1,545,440 1.4 40.00 – 42.50 1,268,160 4.3 6,320,120 4.0 5,734,920 2.7 Above 42.50 1,313,560 4.3 1,925,280 3.6 7,366,360 3.8 9,192,120 2.5 10,976,480 3.4 14,646,720 3.3 In determining the fair value of the employee sharebased awards, the Group uses the BlackScholes optionpricing model. The Company does not anticipate paying any cash dividends in the near future and therefore uses an expected dividend yield of zero in the option valuation model. The expected volatility is based on the historical volatility of public companies that are comparable to the Group over the expected term of the award. The riskfree rate is based on U.S. Treasury zerocoupon rates as the exercise price is based on a fixed USD amount. The expected life of the share options is based on historical data and current expectations. The following table lists the inputs to the BlackScholes optionpricing models used for employee sharebased payments for the years ended December 31, 2015, 2016, and 2017: 2015 2016 2017 Expected volatility (%) 39.4 – 55.9 37.9 – 45.8 32.0 – 43.5 Riskfree interest rate (%) 0.9 – 1.6 0.8 – 1.8 1.4 – 2.0 Expected life of share options (years) 2.8 – 5.2 2.5 – 5.0 2.4 – 4.4 Weightedaverage share price (US$) 36.20 – 46.50 41.20 – 44.40 50.70 – 90.65 Valuation assumptions are determined at each grant date and, as a result, are likely to change for sharebased awards granted in future periods. Changes to the input assumptions could materially affect the estimated fair value of sharebased payment awards. F42

Spotify F1 | Interactive Prospectus Page 234 Page 236

Spotify F1 | Interactive Prospectus Page 234 Page 236