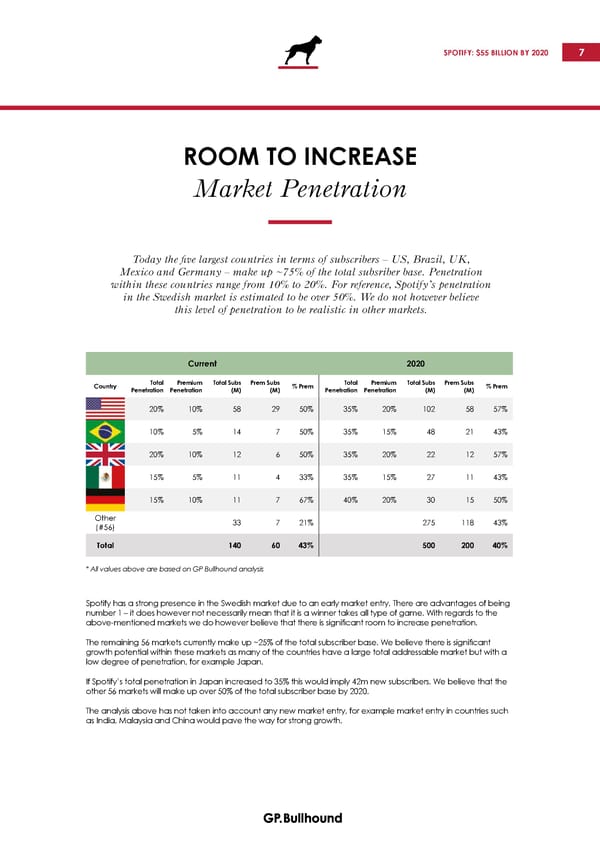

SPOTIFY: $55 BILLION BY 2020 7 ROOM TO INCREASE Market Penetration Today the five largest countries in terms of subscribers – US, Brazil, UK, Mexico and Germany – make up ~75% of the total subsriber base. Penetration within these countries range from 10% to 20%. For reference, Spotify’s penetration in the Swedish market is estimated to be over 50%. We do not however believe this level of penetration to be realistic in other markets. Current 2020 Country Total Premium Total Subs Prem Subs % Prem Total Premium Total Subs Prem Subs % Prem Penetration Penetration (M) (M) Penetration Penetration (M) (M) 20% 10% 58 29 50% 35% 20% 102 58 57% 10% 5% 14 7 50% 35% 15% 48 21 43% 20% 10% 12 6 50% 35% 20% 22 12 57% 15% 5% 11 4 33% 35% 15% 27 11 43% 15% 10% 11 7 67% 40% 20% 30 15 50% Other 33 7 21% 275 118 43% (#56) Total 140 60 43% 500 200 40% * All values above are based on GP Bullhound analysis Spotify has a strong presence in the Swedish market due to an early market entry. There are advantages of being number 1 – it does however not necessarily mean that it is a winner takes all type of game. With regards to the above-mentioned markets we do however believe that there is significant room to increase penetration. The remaining 56 markets currently make up ~25% of the total subscriber base. We believe there is significant growth potential within these markets as many of the countries have a large total addressable market but with a low degree of penetration, for example Japan. If Spotify’s total penetration in Japan increased to 35% this would imply 42m new subscribers. We believe that the other 56 markets will make up over 50% of the total subscriber base by 2020. The analysis above has not taken into account any new market entry, for example market entry in countries such as India, Malaysia and China would pave the way for strong growth.

GP Bullhound Spotify Update October 2017 Page 6 Page 8

GP Bullhound Spotify Update October 2017 Page 6 Page 8