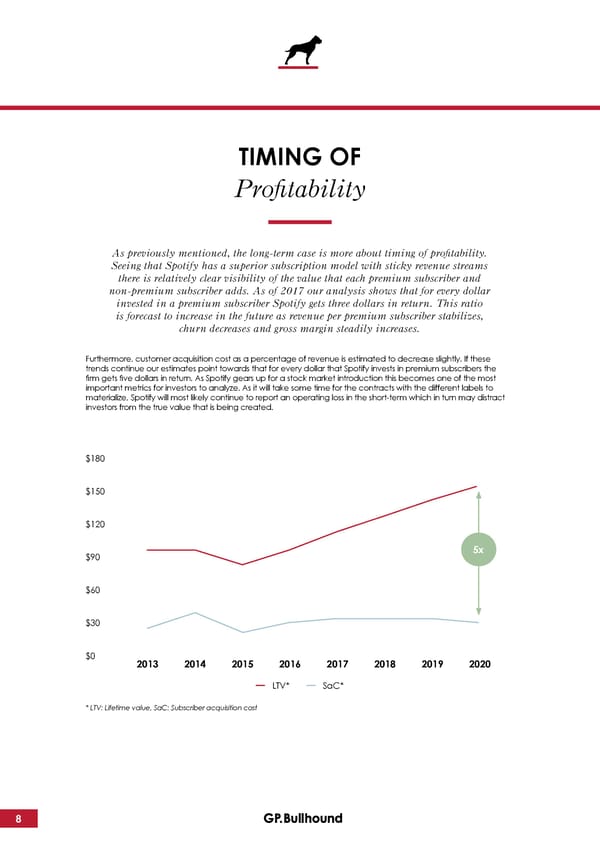

TIMING OF Profitability As previously mentioned, the long-term case is more about timing of profitability. Seeing that Spotify has a superior subscription model with sticky revenue streams there is relatively clear visibility of the value that each premium subscriber and non-premium subscriber adds. As of 2017 our analysis shows that for every dollar invested in a premium subscriber Spotify gets three dollars in return. This ratio is forecast to increase in the future as revenue per premium subscriber stabilizes, churn decreases and gross margin steadily increases. Furthermore, customer acquisition cost as a percentage of revenue is estimated to decrease slightly. If these trends continue our estimates point towards that for every dollar that Spotify invests in premium subscribers the firm gets five dollars in return. As Spotify gears up for a stock market introduction this becomes one of the most important metrics for investors to analyze. As it will take some time for the contracts with the different labels to materialize, Spotify will most likely continue to report an operating loss in the short-term which in turn may distract investors from the true value that is being created. $180 $150 $120 $90 5x $60 $30 $0 2013 2014 2015 2016 2017 2018 2019 2020 LTV* SaC* * LTV: Lifetime value, SaC: Subscriber acquisition cost 8

GP Bullhound Spotify Update October 2017 Page 7 Page 9

GP Bullhound Spotify Update October 2017 Page 7 Page 9