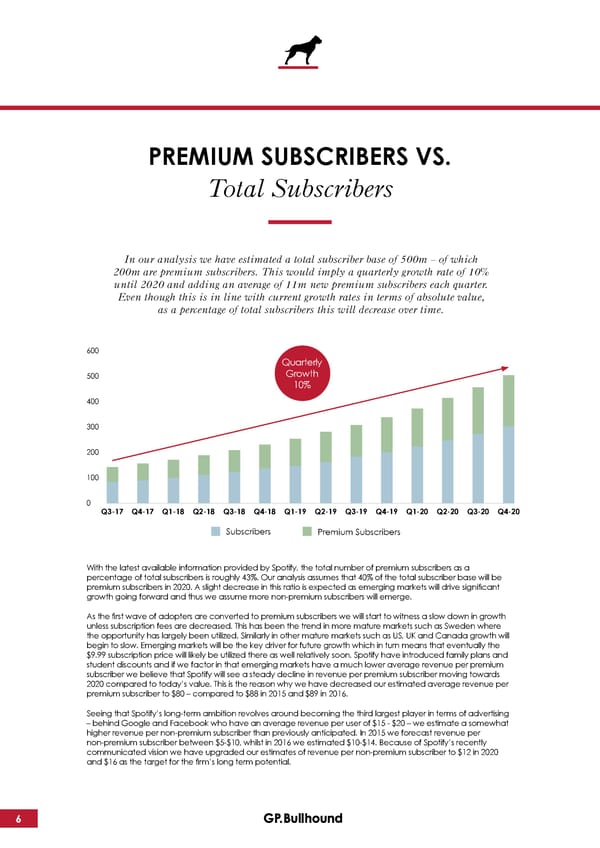

PREMIUM SUBSCRIBERS VS. Total Subscribers In our analysis we have estimated a total subscriber base of 500m – of which 200m are premium subscribers. This would imply a quarterly growth rate of 10% until 2020 and adding an average of 11m new premium subscribers each quarter. Even though this is in line with current growth rates in terms of absolute value, as a percentage of total subscribers this will decrease over time. 600 Quarterly 500 Growth 10% 400 300 200 100 0 Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Subscribers Premium Subscribers With the latest available information provided by Spotify, the total number of premium subscribers as a percentage of total subscribers is roughly 43%. Our analysis assumes that 40% of the total subscriber base will be premium subscribers in 2020. A slight decrease in this ratio is expected as emerging markets will drive significant growth going forward and thus we assume more non-premium subscribers will emerge. As the first wave of adopters are converted to premium subscribers we will start to witness a slow down in growth unless subscription fees are decreased. This has been the trend in more mature markets such as Sweden where the opportunity has largely been utilized. Similarly in other mature markets such as US, UK and Canada growth will begin to slow. Emerging markets will be the key driver for future growth which in turn means that eventually the $9.99 subscription price will likely be utilized there as well relatively soon. Spotify have introduced family plans and student discounts and if we factor in that emerging markets have a much lower average revenue per premium subscriber we believe that Spotify will see a steady decline in revenue per premium subscriber moving towards 2020 compared to today’s value. This is the reason why we have decreased our estimated average revenue per premium subscriber to $80 – compared to $88 in 2015 and $89 in 2016. Seeing that Spotify’s long-term ambition revolves around becoming the third largest player in terms of advertising – behind Google and Facebook who have an average revenue per user of $15 - $20 – we estimate a somewhat higher revenue per non-premium subscriber than previously anticipated. In 2015 we forecast revenue per non-premium subscriber between $5-$10, whilst in 2016 we estimated $10-$14. Because of Spotify’s recently communicated vision we have upgraded our estimates of revenue per non-premium subscriber to $12 in 2020 and $16 as the target for the firm’s long term potential. 6

GP Bullhound Spotify Update October 2017 Page 5 Page 7

GP Bullhound Spotify Update October 2017 Page 5 Page 7