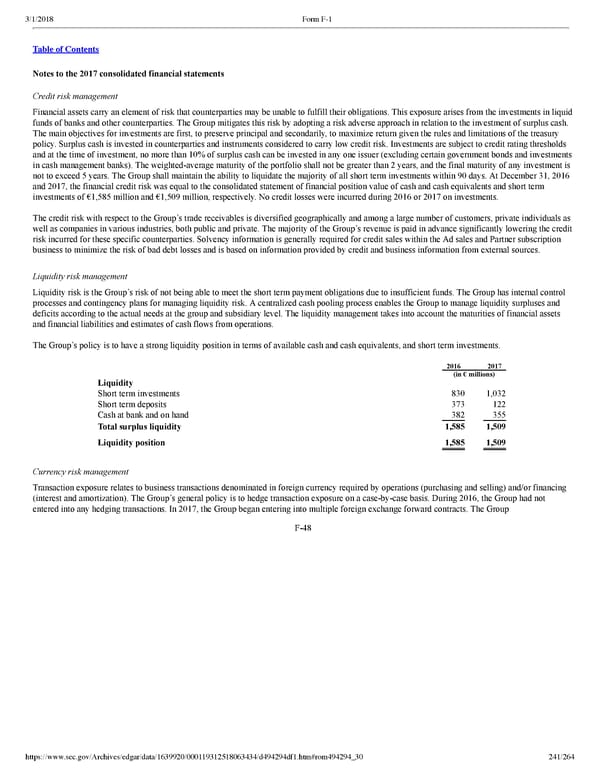

241/264 Notes to the 2017 consolidated financial statements Credit risk management Financial assets carry an element of risk that counterparties may be unable to fulfill their obligations. This exposure arises from the investments in liquid funds of banks and other counterparties. The Group mitigates this risk by adopting a risk adverse approach in relation to the investment of surplus cash. The main objectives for investments are first, to preserve principal and secondarily, to maximize return given the rules and limitations of the treasury policy. Surplus cash is invested in counterparties and instruments considered to carry low credit risk. Investments are subject to credit rating thresholds and at the time of investment, no more than 10% of surplus cash can be invested in any one issuer (excluding certain government bonds and investments in cash management banks). The weightedaverage maturity of the portfolio shall not be greater than 2 years, and the final maturity of any investment is not to exceed 5 years. The Group shall maintain the ability to liquidate the majority of all short term investments within 90 days. At December 31, 2016 and 2017, the financial credit risk was equal to the consolidated statement of financial position value of cash and cash equivalents and short term investments of €1,585 million and €1,509 million, respectively. No credit losses were incurred during 2016 or 2017 on investments. The credit risk with respect to the Group’s trade receivables is diversified geographically and among a large number of customers, private individuals as well as companies in various industries, both public and private. The majority of the Group’s revenue is paid in advance significantly lowering the credit risk incurred for these specific counterparties. Solvency information is generally required for credit sales within the Ad sales and Partner subscription business to minimize the risk of bad debt losses and is based on information provided by credit and business information from external sources. Liquidity risk management Liquidity risk is the Group’s risk of not being able to meet the short term payment obligations due to insufficient funds. The Group has internal control processes and contingency plans for managing liquidity risk. A centralized cash pooling process enables the Group to manage liquidity surpluses and deficits according to the actual needs at the group and subsidiary level. The liquidity management takes into account the maturities of financial assets and financial liabilities and estimates of cash flows from operations. The Group’s policy is to have a strong liquidity position in terms of available cash and cash equivalents, and short term investments. 2016 2017 (in € millions) Liquidity Short term investments 830 1,032 Short term deposits 373 122 Cash at bank and on hand 382 355 Total surplus liquidity 1,585 1,509 Liquidity position 1,585 1,509 Currency risk management Transaction exposure relates to business transactions denominated in foreign currency required by operations (purchasing and selling) and/or financing (interest and amortization). The Group’s general policy is to hedge transaction exposure on a casebycase basis. During 2016, the Group had not entered into any hedging transactions. In 2017, the Group began entering into multiple foreign exchange forward contracts. The Group F48

Spotify F1 | Interactive Prospectus Page 240 Page 242

Spotify F1 | Interactive Prospectus Page 240 Page 242