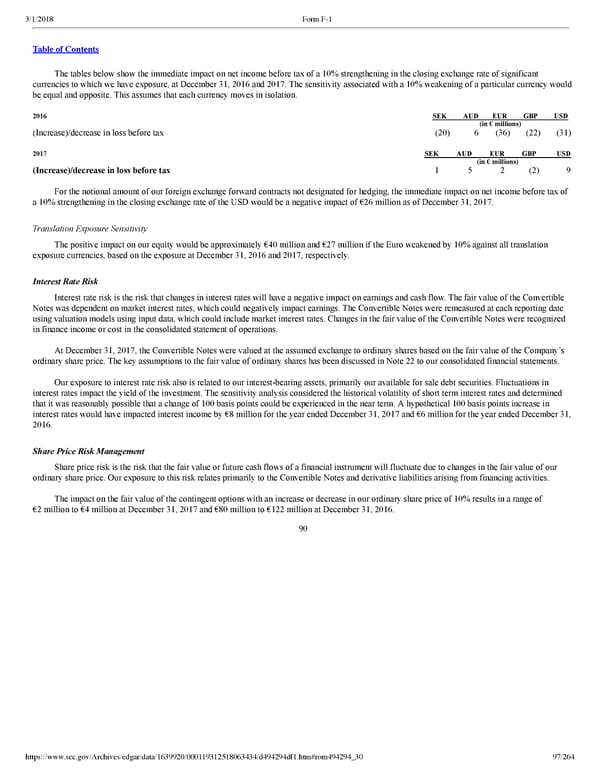

97/264 The tables below show the immediate impact on net income before tax of a 10% strengthening in the closing exchange rate of significant currencies to which we have exposure, at December 31, 2016 and 2017. The sensitivity associated with a 10% weakening of a particular currency would be equal and opposite. This assumes that each currency moves in isolation. 2016 SEK AUD EUR GBP USD (in € millions) (Increase)/decrease in loss before tax (20 ) 6 (36 ) (22 ) (31 ) 2017 SEK AUD EUR GBP USD (in € millions) (Increase)/decrease in loss before tax 1 5 2 (2 ) 9 For the notional amount of our foreign exchange forward contracts not designated for hedging, the immediate impact on net income before tax of a 10% strengthening in the closing exchange rate of the USD would be a negative impact of €26 million as of December 31, 2017. Translation Exposure Sensitivity The positive impact on our equity would be approximately €40 million and €27 million if the Euro weakened by 10% against all translation exposure currencies, based on the exposure at December 31, 2016 and 2017, respectively. Interest Rate Risk Interest rate risk is the risk that changes in interest rates will have a negative impact on earnings and cash flow. The fair value of the Convertible Notes was dependent on market interest rates, which could negatively impact earnings. The Convertible Notes were remeasured at each reporting date using valuation models using input data, which could include market interest rates. Changes in the fair value of the Convertible Notes were recognized in finance income or cost in the consolidated statement of operations. At December 31, 2017, the Convertible Notes were valued at the assumed exchange to ordinary shares based on the fair value of the Company’s ordinary share price. The key assumptions to the fair value of ordinary shares has been discussed in Note 22 to our consolidated financial statements. Our exposure to interest rate risk also is related to our interestbearing assets, primarily our available for sale debt securities. Fluctuations in interest rates impact the yield of the investment. The sensitivity analysis considered the historical volatility of short term interest rates and determined that it was reasonably possible that a change of 100 basis points could be experienced in the near term. A hypothetical 100 basis points increase in interest rates would have impacted interest income by €8 million for the year ended December 31, 2017 and €6 million for the year ended December 31, 2016. Share Price Risk Management Share price risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate due to changes in the fair value of our ordinary share price. Our exposure to this risk relates primarily to the Convertible Notes and derivative liabilities arising from financing activities. The impact on the fair value of the contingent options with an increase or decrease in our ordinary share price of 10% results in a range of €2 million to €4 million at December 31, 2017 and €80 million to €122 million at December 31, 2016. 90

Spotify F1 | Interactive Prospectus Page 96 Page 98

Spotify F1 | Interactive Prospectus Page 96 Page 98