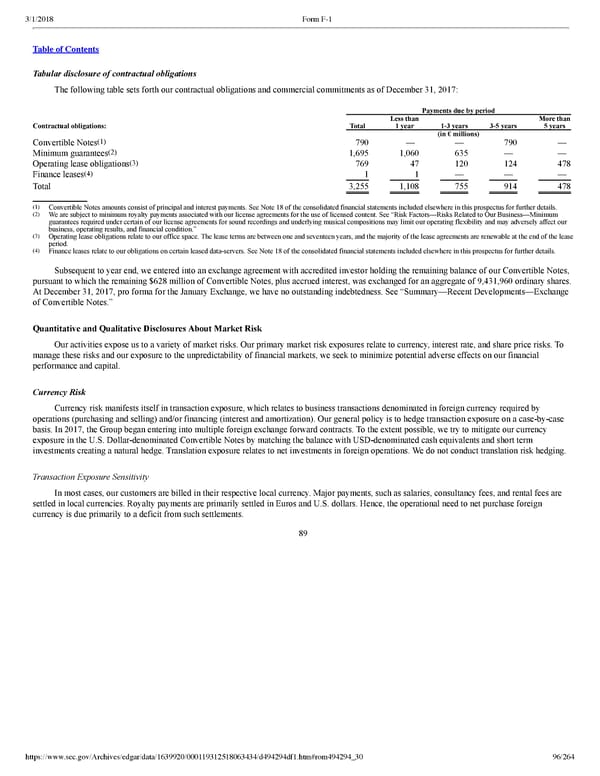

96/264 Tabular disclosure of contractual obligations The following table sets forth our contractual obligations and commercial commitments as of December 31, 2017: Payments due by period Contractual obligations: Total Less than 1 year 13 years 35 years More than 5 years (in € millions) Convertible Notes (1) 790 — — 790 — Minimum guarantees (2) 1,695 1,060 635 — — Operating lease obligations (3) 769 47 120 124 478 Finance leases (4) 1 1 — — — Total 3,255 1,108 755 914 478 ( 1 ) Convertible Notes amounts consist of principal and interest payments. See Note 18 of the consolidated financial statements included elsewhere in this prospectus for further details. ( 2 ) We are subject to minimum royalty payments associated with our license agreements for the use of licensed content. See “Risk Factors—Risks Related to Our Business—Minimum guarantees required under certain of our license agreements for sound recordings and underlying musical compositions may limit our operating flexibility and may adversely affect our business, operating results, and financial condition.” ( 3 ) Operating lease obligations relate to our office space. The lease terms are between one and seventeen years, and the majority of the lease agreements are renewable at the end of the lease period. ( 4 ) Finance leases relate to our obligations on certain leased dataservers. See Note 18 of the consolidated financial statements included elsewhere in this prospectus for further details. Subsequent to year end, we entered into an exchange agreement with accredited investor holding the remaining balance of our Convertible Notes, pursuant to which the remaining $628 million of Convertible Notes, plus accrued interest, was exchanged for an aggregate of 9,431,960 ordinary shares. At December 31, 2017, pro forma for the January Exchange, we have no outstanding indebtedness. See “Summary—Recent Developments—Exchange of Convertible Notes.” Quantitative and Qualitative Disclosures About Market Risk Our activities expose us to a variety of market risks. Our primary market risk exposures relate to currency, interest rate, and share price risks. To manage these risks and our exposure to the unpredictability of financial markets, we seek to minimize potential adverse effects on our financial performance and capital. Currency Risk Currency risk manifests itself in transaction exposure, which relates to business transactions denominated in foreign currency required by operations (purchasing and selling) and/or financing (interest and amortization). Our general policy is to hedge transaction exposure on a casebycase basis. In 2017, the Group began entering into multiple foreign exchange forward contracts. To the extent possible, we try to mitigate our currency exposure in the U.S. Dollardenominated Convertible Notes by matching the balance with USDdenominated cash equivalents and short term investments creating a natural hedge. Translation exposure relates to net investments in foreign operations. We do not conduct translation risk hedging. Transaction Exposure Sensitivity In most cases, our customers are billed in their respective local currency. Major payments, such as salaries, consultancy fees, and rental fees are settled in local currencies. Royalty payments are primarily settled in Euros and U.S. dollars. Hence, the operational need to net purchase foreign currency is due primarily to a deficit from such settlements. 89

Spotify F1 | Interactive Prospectus Page 95 Page 97

Spotify F1 | Interactive Prospectus Page 95 Page 97