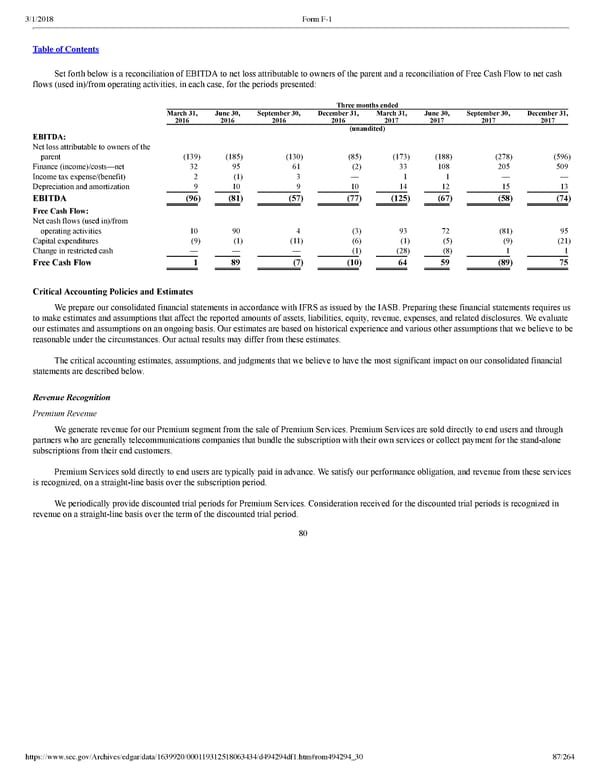

87/264 Set forth below is a reconciliation of EBITDA to net loss attributable to owners of the parent and a reconciliation of Free Cash Flow to net cash flows (used in)/from operating activities, in each case, for the periods presented: Three months ended March 31, 2016 June 30, 2016 September 30, 2016 December 31, 2016 March 31, 2017 June 30, 2017 September 30, 2017 December 31, 2017 (unaudited) EBITDA: Net loss attributable to owners of the parent (139 ) (185 ) (130 ) (85 ) (173 ) (188 ) (278 ) (596 ) Finance (income)/costs—net 32 95 61 (2 ) 33 108 205 509 Income tax expense/(benefit) 2 (1 ) 3 — 1 1 — — Depreciation and amortization 9 10 9 10 14 12 15 13 EBITDA (96 ) (81 ) (57 ) (77 ) (125 ) (67 ) (58 ) (74 ) Free Cash Flow: Net cash flows (used in)/from operating activities 10 90 4 (3 ) 93 72 (81 ) 95 Capital expenditures (9 ) (1 ) (11 ) (6 ) (1 ) (5 ) (9 ) (21 ) Change in restricted cash — — — (1 ) (28 ) (8 ) 1 1 Free Cash Flow 1 89 (7 ) (10 ) 64 59 (89 ) 75 Critical Accounting Policies and Estimates We prepare our consolidated financial statements in accordance with IFRS as issued by the IASB. Preparing these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, equity, revenue, expenses, and related disclosures. We evaluate our estimates and assumptions on an ongoing basis. Our estimates are based on historical experience and various other assumptions that we believe to be reasonable under the circumstances. Our actual results may differ from these estimates. The critical accounting estimates, assumptions, and judgments that we believe to have the most significant impact on our consolidated financial statements are described below. Revenue Recognition Premium Revenue We generate revenue for our Premium segment from the sale of Premium Services. Premium Services are sold directly to end users and through partners who are generally telecommunications companies that bundle the subscription with their own services or collect payment for the standalone subscriptions from their end customers. Premium Services sold directly to end users are typically paid in advance. We satisfy our performance obligation, and revenue from these services is recognized, on a straightline basis over the subscription period. We periodically provide discounted trial periods for Premium Services. Consideration received for the discounted trial periods is recognized in revenue on a straightline basis over the term of the discounted trial period. 80

Spotify F1 | Interactive Prospectus Page 86 Page 88

Spotify F1 | Interactive Prospectus Page 86 Page 88