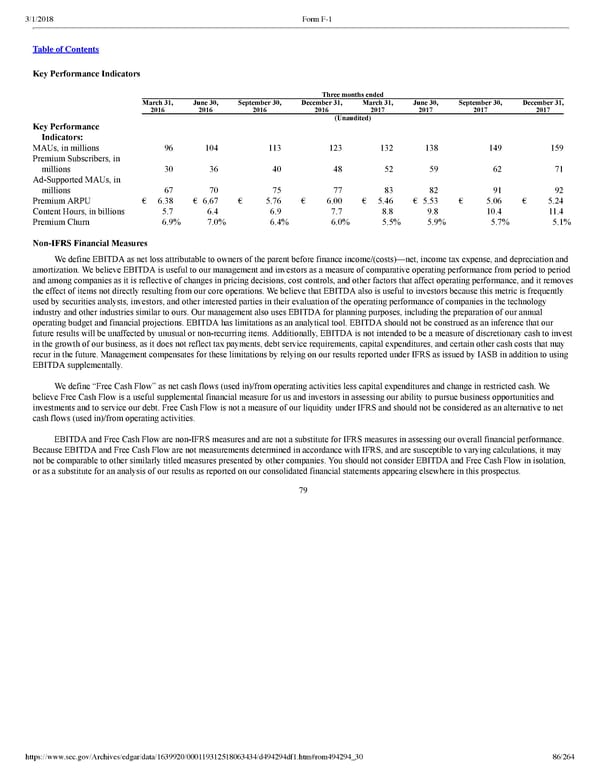

86/264 Key Performance Indicators Three months ended March 31, 2016 June 30, 2016 September 30, 2016 December 31, 2016 March 31, 2017 June 30, 2017 September 30, 2017 December 31, 2017 (Unaudited) Key Performance Indicators: MAUs, in millions 96 104 113 123 132 138 149 159 Premium Subscribers, in millions 30 36 40 48 52 59 62 71 AdSupported MAUs, in millions 67 70 75 77 83 82 91 92 Premium ARPU € 6.38 € 6.67 € 5.76 € 6.00 € 5.46 € 5.53 € 5.06 € 5.24 Content Hours, in billions 5.7 6.4 6.9 7.7 8.8 9.8 10.4 11.4 Premium Churn 6.9 % 7.0 % 6.4 % 6.0 % 5.5 % 5.9 % 5.7 % 5.1 % NonIFRS Financial Measures We define EBITDA as net loss attributable to owners of the parent before finance income/(costs)—net, income tax expense, and depreciation and amortization. We believe EBITDA is useful to our management and investors as a measure of comparative operating performance from period to period and among companies as it is reflective of changes in pricing decisions, cost controls, and other factors that affect operating performance, and it removes the effect of items not directly resulting from our core operations. We believe that EBITDA also is useful to investors because this metric is frequently used by securities analysts, investors, and other interested parties in their evaluation of the operating performance of companies in the technology industry and other industries similar to ours. Our management also uses EBITDA for planning purposes, including the preparation of our annual operating budget and financial projections. EBITDA has limitations as an analytical tool. EBITDA should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items. Additionally, EBITDA is not intended to be a measure of discretionary cash to invest in the growth of our business, as it does not reflect tax payments, debt service requirements, capital expenditures, and certain other cash costs that may recur in the future. Management compensates for these limitations by relying on our results reported under IFRS as issued by IASB in addition to using EBITDA supplementally. We define “Free Cash Flow” as net cash flows (used in)/from operating activities less capital expenditures and change in restricted cash. We believe Free Cash Flow is a useful supplemental financial measure for us and investors in assessing our ability to pursue business opportunities and investments and to service our debt. Free Cash Flow is not a measure of our liquidity under IFRS and should not be considered as an alternative to net cash flows (used in)/from operating activities. EBITDA and Free Cash Flow are nonIFRS measures and are not a substitute for IFRS measures in assessing our overall financial performance. Because EBITDA and Free Cash Flow are not measurements determined in accordance with IFRS, and are susceptible to varying calculations, it may not be comparable to other similarly titled measures presented by other companies. You should not consider EBITDA and Free Cash Flow in isolation, or as a substitute for an analysis of our results as reported on our consolidated financial statements appearing elsewhere in this prospectus. 79

Spotify F1 | Interactive Prospectus Page 85 Page 87

Spotify F1 | Interactive Prospectus Page 85 Page 87