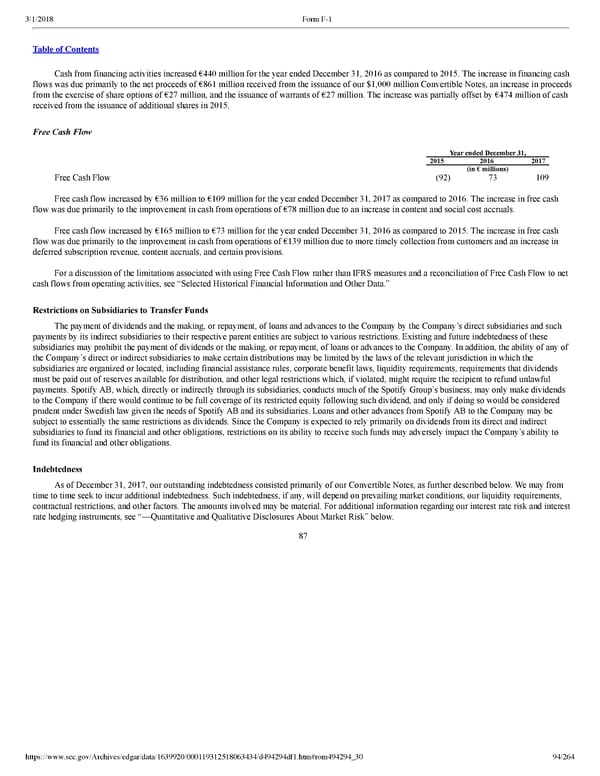

94/264 Cash from financing activities increased €440 million for the year ended December 31, 2016 as compared to 2015. The increase in financing cash flows was due primarily to the net proceeds of €861 million received from the issuance of our $1,000 million Convertible Notes, an increase in proceeds from the exercise of share options of €27 million, and the issuance of warrants of €27 million. The increase was partially offset by €474 million of cash received from the issuance of additional shares in 2015. Free Cash Flow Year ended December 31, 2015 2016 2017 (in € millions) Free Cash Flow (92 ) 73 109 Free cash flow increased by €36 million to €109 million for the year ended December 31, 2017 as compared to 2016. The increase in free cash flow was due primarily to the improvement in cash from operations of €78 million due to an increase in content and social cost accruals. Free cash flow increased by €165 million to €73 million for the year ended December 31, 2016 as compared to 2015. The increase in free cash flow was due primarily to the improvement in cash from operations of €139 million due to more timely collection from customers and an increase in deferred subscription revenue, content accruals, and certain provisions. For a discussion of the limitations associated with using Free Cash Flow rather than IFRS measures and a reconciliation of Free Cash Flow to net cash flows from operating activities, see “Selected Historical Financial Information and Other Data.” Restrictions on Subsidiaries to Transfer Funds The payment of dividends and the making, or repayment, of loans and advances to the Company by the Company’s direct subsidiaries and such payments by its indirect subsidiaries to their respective parent entities are subject to various restrictions. Existing and future indebtedness of these subsidiaries may prohibit the payment of dividends or the making, or repayment, of loans or advances to the Company. In addition, the ability of any of the Company’s direct or indirect subsidiaries to make certain distributions may be limited by the laws of the relevant jurisdiction in which the subsidiaries are organized or located, including financial assistance rules, corporate benefit laws, liquidity requirements, requirements that dividends must be paid out of reserves available for distribution, and other legal restrictions which, if violated, might require the recipient to refund unlawful payments. Spotify AB, which, directly or indirectly through its subsidiaries, conducts much of the Spotify Group’s business, may only make dividends to the Company if there would continue to be full coverage of its restricted equity following such dividend, and only if doing so would be considered prudent under Swedish law given the needs of Spotify AB and its subsidiaries. Loans and other advances from Spotify AB to the Company may be subject to essentially the same restrictions as dividends. Since the Company is expected to rely primarily on dividends from its direct and indirect subsidiaries to fund its financial and other obligations, restrictions on its ability to receive such funds may adversely impact the Company’s ability to fund its financial and other obligations. Indebtedness As of December 31, 2017, our outstanding indebtedness consisted primarily of our Convertible Notes, as further described below. We may from time to time seek to incur additional indebtedness. Such indebtedness, if any, will depend on prevailing market conditions, our liquidity requirements, contractual restrictions, and other factors. The amounts involved may be material. For additional information regarding our interest rate risk and interest rate hedging instruments, see “—Quantitative and Qualitative Disclosures About Market Risk” below. 87

Spotify F1 | Interactive Prospectus Page 93 Page 95

Spotify F1 | Interactive Prospectus Page 93 Page 95