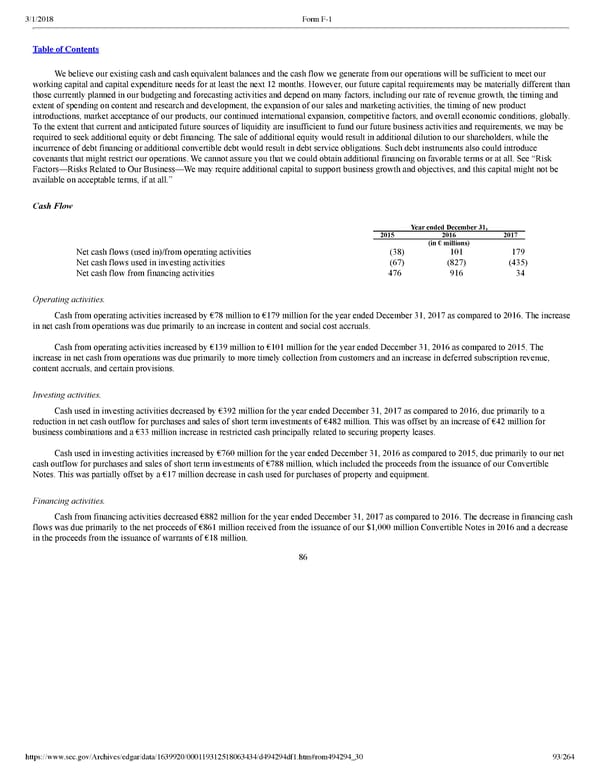

93/264 We believe our existing cash and cash equivalent balances and the cash flow we generate from our operations will be sufficient to meet our working capital and capital expenditure needs for at least the next 12 months. However, our future capital requirements may be materially different than those currently planned in our budgeting and forecasting activities and depend on many factors, including our rate of revenue growth, the timing and extent of spending on content and research and development, the expansion of our sales and marketing activities, the timing of new product introductions, market acceptance of our products, our continued international expansion, competitive factors, and overall economic conditions, globally. To the extent that current and anticipated future sources of liquidity are insufficient to fund our future business activities and requirements, we may be required to seek additional equity or debt financing. The sale of additional equity would result in additional dilution to our shareholders, while the incurrence of debt financing or additional convertible debt would result in debt service obligations. Such debt instruments also could introduce covenants that might restrict our operations. We cannot assure you that we could obtain additional financing on favorable terms or at all. See “Risk Factors—Risks Related to Our Business—We may require additional capital to support business growth and objectives, and this capital might not be available on acceptable terms, if at all.” Cash Flow Year ended December 31, 2015 2016 2017 (in € millions) Net cash flows (used in)/from operating activities (38 ) 101 179 Net cash flows used in investing activities (67 ) (827 ) (435 ) Net cash flow from financing activities 476 916 34 Operating activities. Cash from operating activities increased by €78 million to €179 million for the year ended December 31, 2017 as compared to 2016. The increase in net cash from operations was due primarily to an increase in content and social cost accruals. Cash from operating activities increased by €139 million to €101 million for the year ended December 31, 2016 as compared to 2015. The increase in net cash from operations was due primarily to more timely collection from customers and an increase in deferred subscription revenue, content accruals, and certain provisions. Investing activities. Cash used in investing activities decreased by €392 million for the year ended December 31, 2017 as compared to 2016, due primarily to a reduction in net cash outflow for purchases and sales of short term investments of €482 million. This was offset by an increase of €42 million for business combinations and a €33 million increase in restricted cash principally related to securing property leases. Cash used in investing activities increased by €760 million for the year ended December 31, 2016 as compared to 2015, due primarily to our net cash outflow for purchases and sales of short term investments of €788 million, which included the proceeds from the issuance of our Convertible Notes. This was partially offset by a €17 million decrease in cash used for purchases of property and equipment. Financing activities. Cash from financing activities decreased €882 million for the year ended December 31, 2017 as compared to 2016. The decrease in financing cash flows was due primarily to the net proceeds of €861 million received from the issuance of our $1,000 million Convertible Notes in 2016 and a decrease in the proceeds from the issuance of warrants of €18 million. 86

Spotify F1 | Interactive Prospectus Page 92 Page 94

Spotify F1 | Interactive Prospectus Page 92 Page 94