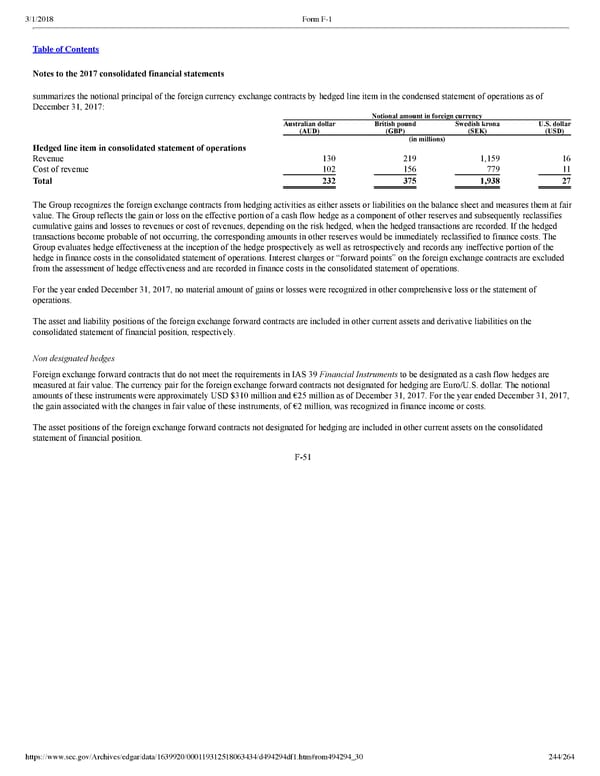

244/264 Notes to the 2017 consolidated financial statements summarizes the notional principal of the foreign currency exchange contracts by hedged line item in the condensed statement of operations as of December 31, 2017: Notional amount in foreign currency Australian dollar (AUD) British pound (GBP) Swedish krona (SEK) U.S. dollar (USD) (in millions) Hedged line item in consolidated statement of operations Revenue 130 219 1,159 16 Cost of revenue 102 156 779 11 Total 232 375 1,938 27 The Group recognizes the foreign exchange contracts from hedging activities as either assets or liabilities on the balance sheet and measures them at fair value. The Group reflects the gain or loss on the effective portion of a cash flow hedge as a component of other reserves and subsequently reclassifies cumulative gains and losses to revenues or cost of revenues, depending on the risk hedged, when the hedged transactions are recorded. If the hedged transactions become probable of not occurring, the corresponding amounts in other reserves would be immediately reclassified to finance costs. The Group evaluates hedge effectiveness at the inception of the hedge prospectively as well as retrospectively and records any ineffective portion of the hedge in finance costs in the consolidated statement of operations. Interest charges or “forward points” on the foreign exchange contracts are excluded from the assessment of hedge effectiveness and are recorded in finance costs in the consolidated statement of operations. For the year ended December 31, 2017, no material amount of gains or losses were recognized in other comprehensive loss or the statement of operations. The asset and liability positions of the foreign exchange forward contracts are included in other current assets and derivative liabilities on the consolidated statement of financial position, respectively. Non designated hedges Foreign exchange forward contracts that do not meet the requirements in IAS 39 Financial Instruments to be designated as a cash flow hedges are measured at fair value. The currency pair for the foreign exchange forward contracts not designated for hedging are Euro/U.S. dollar. The notional amounts of these instruments were approximately USD $310 million and €25 million as of December 31, 2017. For the year ended December 31, 2017, the gain associated with the changes in fair value of these instruments, of €2 million, was recognized in finance income or costs. The asset positions of the foreign exchange forward contracts not designated for hedging are included in other current assets on the consolidated statement of financial position. F51

Spotify F1 | Interactive Prospectus Page 243 Page 245

Spotify F1 | Interactive Prospectus Page 243 Page 245