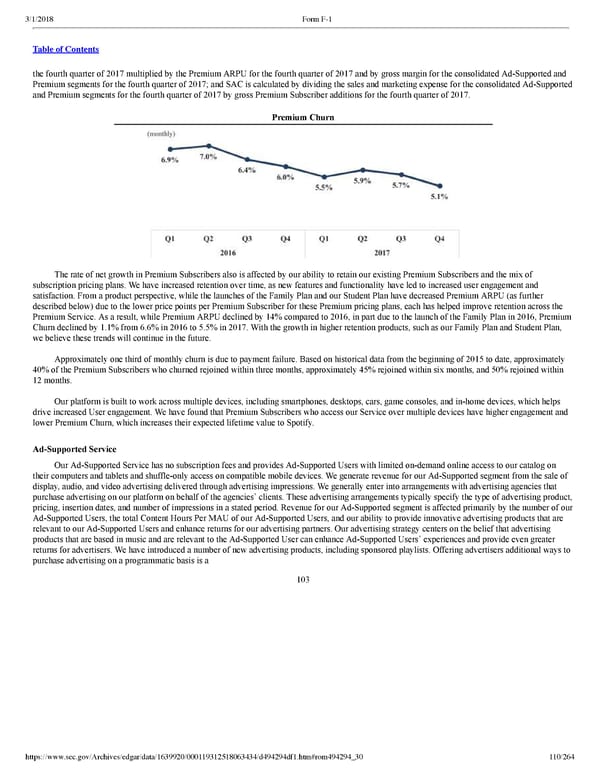

110/264 the fourth quarter of 2017 multiplied by the Premium ARPU for the fourth quarter of 2017 and by gross margin for the consolidated AdSupported and Premium segments for the fourth quarter of 2017; and SAC is calculated by dividing the sales and marketing expense for the consolidated AdSupported and Premium segments for the fourth quarter of 2017 by gross Premium Subscriber additions for the fourth quarter of 2017. Premium Churn The rate of net growth in Premium Subscribers also is affected by our ability to retain our existing Premium Subscribers and the mix of subscription pricing plans. We have increased retention over time, as new features and functionality have led to increased user engagement and satisfaction. From a product perspective, while the launches of the Family Plan and our Student Plan have decreased Premium ARPU (as further described below) due to the lower price points per Premium Subscriber for these Premium pricing plans, each has helped improve retention across the Premium Service. As a result, while Premium ARPU declined by 14% compared to 2016, in part due to the launch of the Family Plan in 2016, Premium Churn declined by 1.1% from 6.6% in 2016 to 5.5% in 2017. With the growth in higher retention products, such as our Family Plan and Student Plan, we believe these trends will continue in the future. Approximately one third of monthly churn is due to payment failure. Based on historical data from the beginning of 2015 to date, approximately 40% of the Premium Subscribers who churned rejoined within three months, approximately 45% rejoined within six months, and 50% rejoined within 12 months. Our platform is built to work across multiple devices, including smartphones, desktops, cars, game consoles, and inhome devices, which helps drive increased User engagement. We have found that Premium Subscribers who access our Service over multiple devices have higher engagement and lower Premium Churn, which increases their expected lifetime value to Spotify. AdSupported Service Our AdSupported Service has no subscription fees and provides AdSupported Users with limited ondemand online access to our catalog on their computers and tablets and shuffleonly access on compatible mobile devices. We generate revenue for our AdSupported segment from the sale of display, audio, and video advertising delivered through advertising impressions. We generally enter into arrangements with advertising agencies that purchase advertising on our platform on behalf of the agencies’ clients. These advertising arrangements typically specify the type of advertising product, pricing, insertion dates, and number of impressions in a stated period. Revenue for our AdSupported segment is affected primarily by the number of our AdSupported Users, the total Content Hours Per MAU of our AdSupported Users, and our ability to provide innovative advertising products that are relevant to our AdSupported Users and enhance returns for our advertising partners. Our advertising strategy centers on the belief that advertising products that are based in music and are relevant to the AdSupported User can enhance AdSupported Users’ experiences and provide even greater returns for advertisers. We have introduced a number of new advertising products, including sponsored playlists. Offering advertisers additional ways to purchase advertising on a programmatic basis is a 103

Spotify F1 | Interactive Prospectus Page 109 Page 111

Spotify F1 | Interactive Prospectus Page 109 Page 111