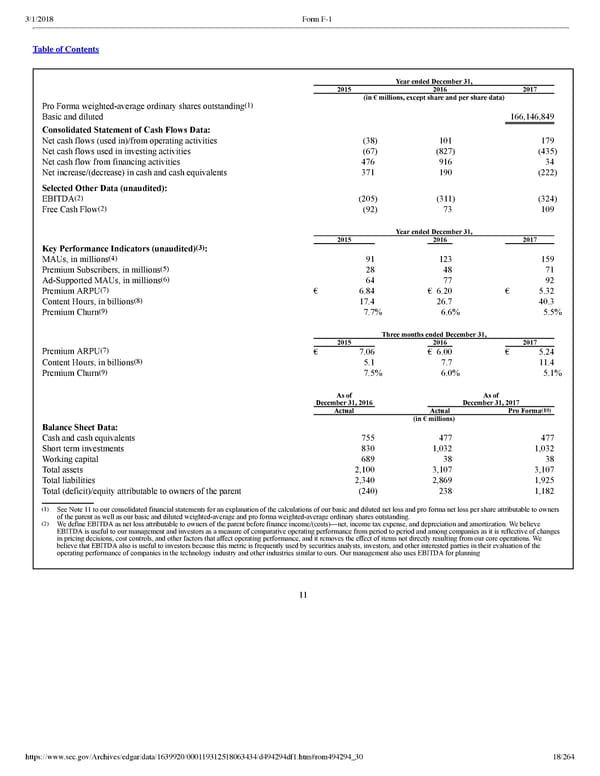

18/264 Year ended December 31, 2015 2016 2017 (in € millions, except share and per share data) Pro Forma weightedaverage ordinary shares outstanding (1) Basic and diluted 166,146,849 Consolidated Statement of Cash Flows Data: Net cash flows (used in)/from operating activities (38 ) 101 179 Net cash flows used in investing activities (67 ) (827 ) (435 ) Net cash flow from financing activities 476 916 34 Net increase/(decrease) in cash and cash equivalents 371 190 (222 ) Selected Other Data (unaudited): EBITDA (2) (205 ) (311 ) (324 ) Free Cash Flow (2) (92 ) 73 109 Year ended December 31, 2015 2016 2017 Key Performance Indicators (unaudited) (3) : MAUs, in millions (4) 91 123 159 Premium Subscribers, in millions (5) 28 48 71 AdSupported MAUs, in millions (6) 64 77 92 Premium ARPU (7) € 6.84 € 6.20 € 5.32 Content Hours, in billions (8) 17.4 26.7 40.3 Premium Churn (9) 7.7 % 6.6 % 5.5 % Three months ended December 31, 2015 2016 2017 Premium ARPU (7) € 7.06 € 6.00 € 5.24 Content Hours, in billions (8) 5.1 7.7 11.4 Premium Churn (9) 7.5 % 6.0 % 5.1 % As of December 31, 2016 As of December 31, 2017 Actual Actual Pro Forma ( 1 0 ) (in € millions) Balance Sheet Data: Cash and cash equivalents 755 477 477 Short term investments 830 1,032 1,032 Working capital 689 38 38 Total assets 2,100 3,107 3,107 Total liabilities 2,340 2,869 1,925 Total (deficit)/equity attributable to owners of the parent (240 ) 238 1,182 ( 1 ) See Note 11 to our consolidated financial statements for an explanation of the calculations of our basic and diluted net loss and pro forma net loss per share attributable to owners of the parent as well as our basic and diluted weightedaverage and pro forma weightedaverage ordinary shares outstanding. ( 2 ) We define EBITDA as net loss attributable to owners of the parent before finance income/(costs)—net, income tax expense, and depreciation and amortization. We believe EBITDA is useful to our management and investors as a measure of comparative operating performance from period to period and among companies as it is reflective of changes in pricing decisions, cost controls, and other factors that affect operating performance, and it removes the effect of items not directly resulting from our core operations. We believe that EBITDA also is useful to investors because this metric is frequently used by securities analysts, investors, and other interested parties in their evaluation of the operating performance of companies in the technology industry and other industries similar to ours. Our management also uses EBITDA for planning 11

Spotify F1 | Interactive Prospectus Page 17 Page 19

Spotify F1 | Interactive Prospectus Page 17 Page 19