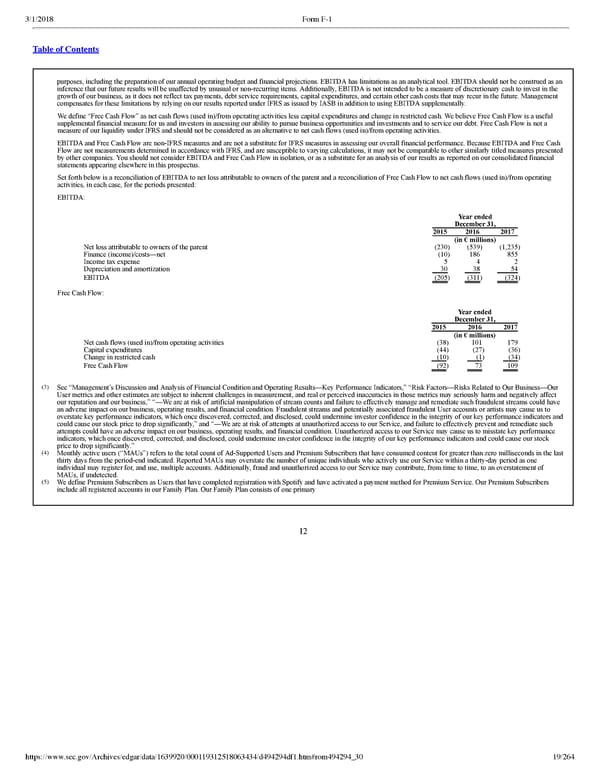

19/264 purposes, including the preparation of our annual operating budget and financial projections. EBITDA has limitations as an analytical tool. EBITDA should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items. Additionally, EBITDA is not intended to be a measure of discretionary cash to invest in the growth of our business, as it does not reflect tax payments, debt service requirements, capital expenditures, and certain other cash costs that may recur in the future. Management compensates for these limitations by relying on our results reported under IFRS as issued by IASB in addition to using EBITDA supplementally. We define “Free Cash Flow” as net cash flows (used in)/from operating activities less capital expenditures and change in restricted cash. We believe Free Cash Flow is a useful supplemental financial measure for us and investors in assessing our ability to pursue business opportunities and investments and to service our debt. Free Cash Flow is not a measure of our liquidity under IFRS and should not be considered as an alternative to net cash flows (used in)/from operating activities. EBITDA and Free Cash Flow are nonIFRS measures and are not a substitute for IFRS measures in assessing our overall financial performance. Because EBITDA and Free Cash Flow are not measurements determined in accordance with IFRS, and are susceptible to varying calculations, it may not be comparable to other similarly titled measures presented by other companies. You should not consider EBITDA and Free Cash Flow in isolation, or as a substitute for an analysis of our results as reported on our consolidated financial statements appearing elsewhere in this prospectus. Set forth below is a reconciliation of EBITDA to net loss attributable to owners of the parent and a reconciliation of Free Cash Flow to net cash flows (used in)/from operating activities, in each case, for the periods presented: EBITDA: Year ended December 31, 2015 2016 2017 (in € millions) Net loss attributable to owners of the parent (230 ) (539 ) (1,235 ) Finance (income)/costs—net (10 ) 186 855 Income tax expense 5 4 2 Depreciation and amortization 30 38 54 EBITDA (205 ) (311 ) (324 ) Free Cash Flow: Year ended December 31, 2015 2016 2017 (in € millions) Net cash flows (used in)/from operating activities (38 ) 101 179 Capital expenditures (44 ) (27 ) (36 ) Change in restricted cash (10 ) (1 ) (34 ) Free Cash Flow (92 ) 73 109 ( 3 ) See “Management’s Discussion and Analysis of Financial Condition and Operating Results—Key Performance Indicators,” “Risk Factors—Risks Related to Our Business—Our User metrics and other estimates are subject to inherent challenges in measurement, and real or perceived inaccuracies in those metrics may seriously harm and negatively affect our reputation and our business,” “—We are at risk of artificial manipulation of stream counts and failure to effectively manage and remediate such fraudulent streams could have an adverse impact on our business, operating results, and financial condition. Fraudulent streams and potentially associated fraudulent User accounts or artists may cause us to overstate key performance indicators, which once discovered, corrected, and disclosed, could undermine investor confidence in the integrity of our key performance indicators and could cause our stock price to drop significantly,” and “—We are at risk of attempts at unauthorized access to our Service, and failure to effectively prevent and remediate such attempts could have an adverse impact on our business, operating results, and financial condition. Unauthorized access to our Service may cause us to misstate key performance indicators, which once discovered, corrected, and disclosed, could undermine investor confidence in the integrity of our key performance indicators and could cause our stock price to drop significantly.” ( 4 ) Monthly active users (“MAUs”) refers to the total count of AdSupported Users and Premium Subscribers that have consumed content for greater than zero milliseconds in the last thirty days from the periodend indicated. Reported MAUs may overstate the number of unique individuals who actively use our Service within a thirtyday period as one individual may register for, and use, multiple accounts. Additionally, fraud and unauthorized access to our Service may contribute, from time to time, to an overstatement of MAUs, if undetected. ( 5 ) We define Premium Subscribers as Users that have completed registration with Spotify and have activated a payment method for Premium Service. Our Premium Subscribers include all registered accounts in our Family Plan. Our Family Plan consists of one primary 12

Spotify F1 | Interactive Prospectus Page 18 Page 20

Spotify F1 | Interactive Prospectus Page 18 Page 20