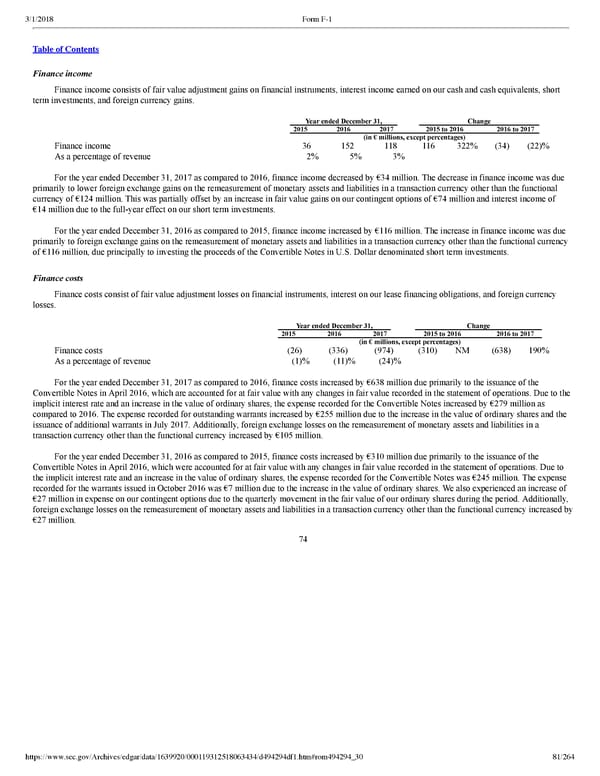

81/264 Finance income Finance income consists of fair value adjustment gains on financial instruments, interest income earned on our cash and cash equivalents, short term investments, and foreign currency gains. Year ended December 31, Change 2015 2016 2017 2015 to 2016 2016 to 2017 (in € millions, except percentages) Finance income 36 152 118 116 322 % (34 ) (22 )% As a percentage of revenue 2 % 5 % 3 % For the year ended December 31, 2017 as compared to 2016, finance income decreased by €34 million. The decrease in finance income was due primarily to lower foreign exchange gains on the remeasurement of monetary assets and liabilities in a transaction currency other than the functional currency of €124 million. This was partially offset by an increase in fair value gains on our contingent options of €74 million and interest income of €14 million due to the fullyear effect on our short term investments. For the year ended December 31, 2016 as compared to 2015, finance income increased by €116 million. The increase in finance income was due primarily to foreign exchange gains on the remeasurement of monetary assets and liabilities in a transaction currency other than the functional currency of €116 million, due principally to investing the proceeds of the Convertible Notes in U.S. Dollar denominated short term investments. Finance costs Finance costs consist of fair value adjustment losses on financial instruments, interest on our lease financing obligations, and foreign currency losses. Year ended December 31, Change 2015 2016 2017 2015 to 2016 2016 to 2017 (in € millions, except percentages) Finance costs (26 ) (336 ) (974 ) (310 ) NM (638 ) 190 % As a percentage of revenue (1 )% (11 )% (24 )% For the year ended December 31, 2017 as compared to 2016, finance costs increased by €638 million due primarily to the issuance of the Convertible Notes in April 2016, which are accounted for at fair value with any changes in fair value recorded in the statement of operations. Due to the implicit interest rate and an increase in the value of ordinary shares, the expense recorded for the Convertible Notes increased by €279 million as compared to 2016. The expense recorded for outstanding warrants increased by €255 million due to the increase in the value of ordinary shares and the issuance of additional warrants in July 2017. Additionally, foreign exchange losses on the remeasurement of monetary assets and liabilities in a transaction currency other than the functional currency increased by €105 million. For the year ended December 31, 2016 as compared to 2015, finance costs increased by €310 million due primarily to the issuance of the Convertible Notes in April 2016, which were accounted for at fair value with any changes in fair value recorded in the statement of operations. Due to the implicit interest rate and an increase in the value of ordinary shares, the expense recorded for the Convertible Notes was €245 million. The expense recorded for the warrants issued in October 2016 was €7 million due to the increase in the value of ordinary shares. We also experienced an increase of €27 million in expense on our contingent options due to the quarterly movement in the fair value of our ordinary shares during the period. Additionally, foreign exchange losses on the remeasurement of monetary assets and liabilities in a transaction currency other than the functional currency increased by €27 million. 74

Spotify F1 | Interactive Prospectus Page 80 Page 82

Spotify F1 | Interactive Prospectus Page 80 Page 82