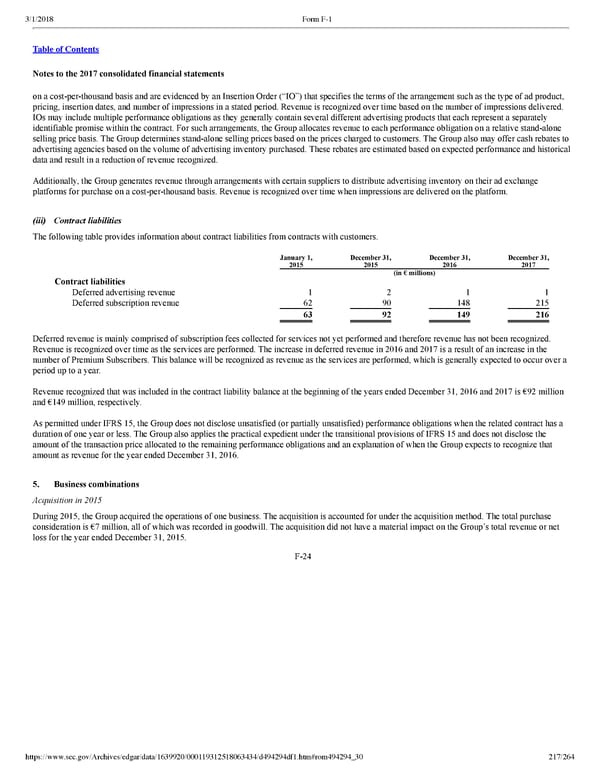

217/264 Notes to the 2017 consolidated financial statements on a costperthousand basis and are evidenced by an Insertion Order (“IO”) that specifies the terms of the arrangement such as the type of ad product, pricing, insertion dates, and number of impressions in a stated period. Revenue is recognized over time based on the number of impressions delivered. IOs may include multiple performance obligations as they generally contain several different advertising products that each represent a separately identifiable promise within the contract. For such arrangements, the Group allocates revenue to each performance obligation on a relative standalone selling price basis. The Group determines standalone selling prices based on the prices charged to customers. The Group also may offer cash rebates to advertising agencies based on the volume of advertising inventory purchased. These rebates are estimated based on expected performance and historical data and result in a reduction of revenue recognized. Additionally, the Group generates revenue through arrangements with certain suppliers to distribute advertising inventory on their ad exchange platforms for purchase on a costperthousand basis. Revenue is recognized over time when impressions are delivered on the platform. (iii) Contract liabilities The following table provides information about contract liabilities from contracts with customers. January 1, 2015 December 31, 2015 December 31, 2016 December 31, 2017 (in € millions) Contract liabilities Deferred advertising revenue 1 2 1 1 Deferred subscription revenue 62 90 148 215 63 92 149 216 Deferred revenue is mainly comprised of subscription fees collected for services not yet performed and therefore revenue has not been recognized. Revenue is recognized over time as the services are performed. The increase in deferred revenue in 2016 and 2017 is a result of an increase in the number of Premium Subscribers. This balance will be recognized as revenue as the services are performed, which is generally expected to occur over a period up to a year. Revenue recognized that was included in the contract liability balance at the beginning of the years ended December 31, 2016 and 2017 is €92 million and €149 million, respectively. As permitted under IFRS 15, the Group does not disclose unsatisfied (or partially unsatisfied) performance obligations when the related contract has a duration of one year or less. The Group also applies the practical expedient under the transitional provisions of IFRS 15 and does not disclose the amount of the transaction price allocated to the remaining performance obligations and an explanation of when the Group expects to recognize that amount as revenue for the year ended December 31, 2016. 5. Business combinations Acquisition in 2015 During 2015, the Group acquired the operations of one business. The acquisition is accounted for under the acquisition method. The total purchase consideration is €7 million, all of which was recorded in goodwill. The acquisition did not have a material impact on the Group’s total revenue or net loss for the year ended December 31, 2015. F24

Spotify F1 | Interactive Prospectus Page 216 Page 218

Spotify F1 | Interactive Prospectus Page 216 Page 218