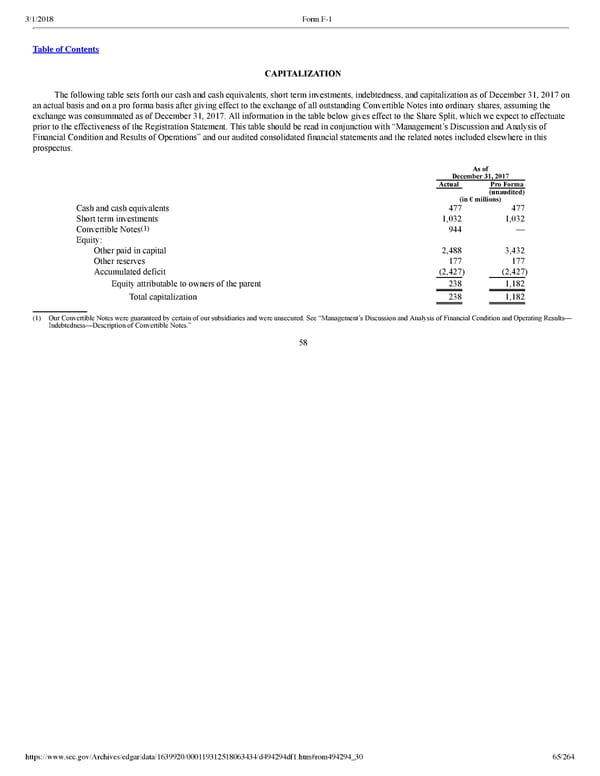

65/264 CAPITALIZATION The following table sets forth our cash and cash equivalents, short term investments, indebtedness, and capitalization as of December 31, 2017 on an actual basis and on a pro forma basis after giving effect to the exchange of all outstanding Convertible Notes into ordinary shares, assuming the exchange was consummated as of December 31, 2017. All information in the table below gives effect to the Share Split, which we expect to effectuate prior to the effectiveness of the Registration Statement. This table should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and the related notes included elsewhere in this prospectus. As of December 31, 2017 Actual Pro Forma (unaudited) (in € millions) Cash and cash equivalents 477 477 Short term investments 1,032 1,032 Convertible Notes (1) 944 — Equity: Other paid in capital 2,488 3,432 Other reserves 177 177 Accumulated deficit (2,427 ) (2,427 ) Equity attributable to owners of the parent 238 1,182 Total capitalization 238 1,182 (1) Our Convertible Notes were guaranteed by certain of our subsidiaries and were unsecured. See “Management’s Discussion and Analysis of Financial Condition and Operating Results— Indebtedness—Description of Convertible Notes.” 58

Spotify F1 | Interactive Prospectus Page 64 Page 66

Spotify F1 | Interactive Prospectus Page 64 Page 66