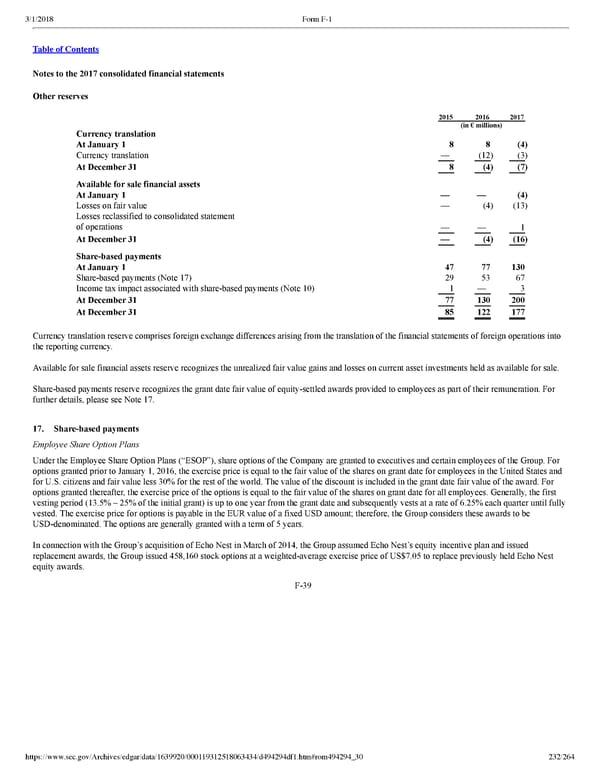

232/264 Notes to the 2017 consolidated financial statements Other reserves 2015 2016 2017 (in € millions) Currency translation At January 1 8 8 (4 ) Currency translation — (12 ) (3 ) At December 31 8 (4 ) (7 ) Available for sale financial assets At January 1 — — (4 ) Losses on fair value — (4 ) (13 ) Losses reclassified to consolidated statement of operations — — 1 At December 31 — (4 ) (16 ) Sharebased payments At January 1 47 77 130 Sharebased payments (Note 17) 29 53 67 Income tax impact associated with sharebased payments (Note 10) 1 — 3 At December 31 77 130 200 At December 31 85 122 177 Currency translation reserve comprises foreign exchange differences arising from the translation of the financial statements of foreign operations into the reporting currency. Available for sale financial assets reserve recognizes the unrealized fair value gains and losses on current asset investments held as available for sale. Sharebased payments reserve recognizes the grant date fair value of equitysettled awards provided to employees as part of their remuneration. For further details, please see Note 17. 17. Sharebased payments Employee Share Option Plans Under the Employee Share Option Plans (“ESOP”), share options of the Company are granted to executives and certain employees of the Group. For options granted prior to January 1, 2016, the exercise price is equal to the fair value of the shares on grant date for employees in the United States and for U.S. citizens and fair value less 30% for the rest of the world. The value of the discount is included in the grant date fair value of the award. For options granted thereafter, the exercise price of the options is equal to the fair value of the shares on grant date for all employees. Generally, the first vesting period (13.5% – 25% of the initial grant) is up to one year from the grant date and subsequently vests at a rate of 6.25% each quarter until fully vested. The exercise price for options is payable in the EUR value of a fixed USD amount; therefore, the Group considers these awards to be USDdenominated. The options are generally granted with a term of 5 years. In connection with the Group’s acquisition of Echo Nest in March of 2014, the Group assumed Echo Nest’s equity incentive plan and issued replacement awards, the Group issued 458,160 stock options at a weightedaverage exercise price of US$7.05 to replace previously held Echo Nest equity awards. F39

Spotify F1 | Interactive Prospectus Page 231 Page 233

Spotify F1 | Interactive Prospectus Page 231 Page 233