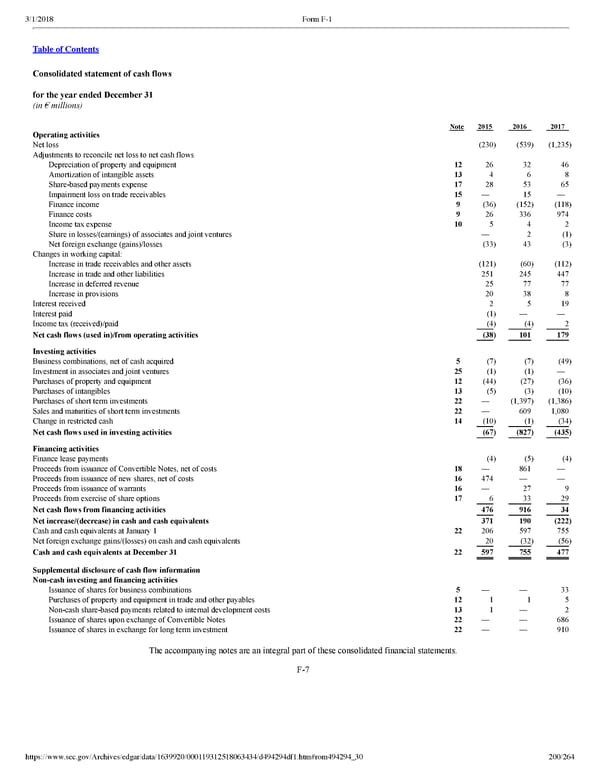

200/264 Consolidated statement of cash flows for the year ended December 31 (in € millions) Note 2015 2016 2017 Operating activities Net loss (230 ) (539 ) (1,235 ) Adjustments to reconcile net loss to net cash flows Depreciation of property and equipment 12 26 32 46 Amortization of intangible assets 13 4 6 8 Sharebased payments expense 17 28 53 65 Impairment loss on trade receivables 15 — 15 — Finance income 9 (36 ) (152 ) (118 ) Finance costs 9 26 336 974 Income tax expense 10 5 4 2 Share in losses/(earnings) of associates and joint ventures — 2 (1 ) Net foreign exchange (gains)/losses (33 ) 43 (3 ) Changes in working capital: Increase in trade receivables and other assets (121 ) (60 ) (112 ) Increase in trade and other liabilities 251 245 447 Increase in deferred revenue 25 77 77 Increase in provisions 20 38 8 Interest received 2 5 19 Interest paid (1 ) — — Income tax (received)/paid (4 ) (4 ) 2 Net cash flows (used in)/fr om operating activities (38 ) 101 179 Investing activities Business combinations, net of cash acquired 5 (7 ) (7 ) (49 ) Investment in associates and joint ventures 25 (1 ) (1 ) — Purchases of property and equipment 12 (44 ) (27 ) (36 ) Purchases of intangibles 13 (5 ) (3 ) (10 ) Purchases of short term investments 22 — (1,397 ) (1,386 ) Sales and maturities of short term investments 22 — 609 1,080 Change in restricted cash 14 (10 ) (1 ) (34 ) Net cash flows used in investing activities (67 ) (827 ) (435 ) Financing activities Finance lease payments (4 ) (5 ) (4 ) Proceeds from issuance of Convertible Notes, net of costs 18 — 861 — Proceeds from issuance of new shares, net of costs 16 474 — — Proceeds from issuance of warrants 16 — 27 9 Proceeds from exercise of share options 17 6 33 29 Net cash flows fr om financing activities 476 916 34 Net incr ease/(decr ease) in cash and cash equivalents 371 190 (222 ) Cash and cash equivalents at January 1 22 206 597 755 Net foreign exchange gains/(losses) on cash and cash equivalents 20 (32 ) (56 ) Cash and cash equivalents at December 31 22 597 755 477 Supplemental disclosur e of cash flow information Noncash investing and financing activities Issuance of shares for business combinations 5 — — 33 Purchases of property and equipment in trade and other payables 12 1 1 5 Noncash sharebased payments related to internal development costs 13 1 — 2 Issuance of shares upon exchange of Convertible Notes 22 — — 686 Issuance of shares in exchange for long term investment 22 — — 910 The accompanying notes are an integral part of these consolidated financial statements. F7

Spotify F1 | Interactive Prospectus Page 199 Page 201

Spotify F1 | Interactive Prospectus Page 199 Page 201