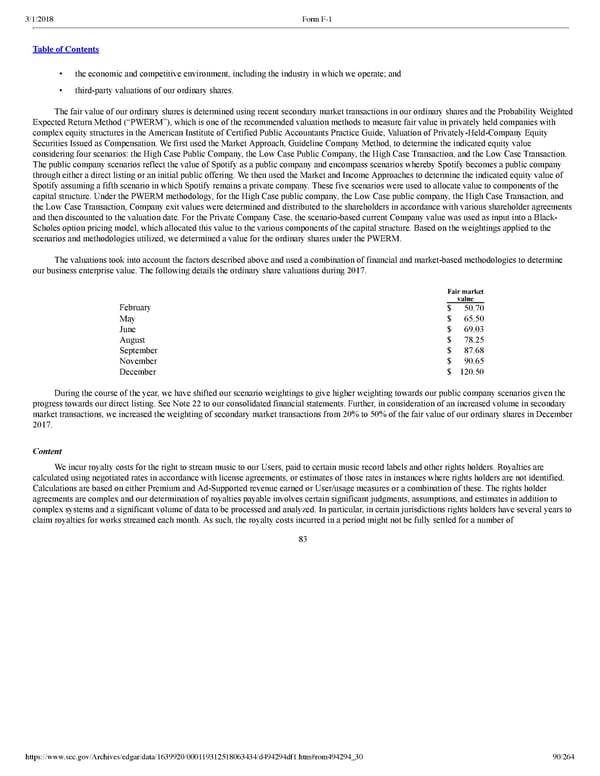

90/264 • the economic and competitive environment, including the industry in which we operate; and • thirdparty valuations of our ordinary shares. The fair value of our ordinary shares is determined using recent secondary market transactions in our ordinary shares and the Probability Weighted Expected Return Method (“PWERM”), which is one of the recommended valuation methods to measure fair value in privately held companies with complex equity structures in the American Institute of Certified Public Accountants Practice Guide, Valuation of PrivatelyHeldCompany Equity Securities Issued as Compensation. We first used the Market Approach, Guideline Company Method, to determine the indicated equity value considering four scenarios: the High Case Public Company, the Low Case Public Company, the High Case Transaction, and the Low Case Transaction. The public company scenarios reflect the value of Spotify as a public company and encompass scenarios whereby Spotify becomes a public company through either a direct listing or an initial public offering. We then used the Market and Income Approaches to determine the indicated equity value of Spotify assuming a fifth scenario in which Spotify remains a private company. These five scenarios were used to allocate value to components of the capital structure. Under the PWERM methodology, for the High Case public company, the Low Case public company, the High Case Transaction, and the Low Case Transaction, Company exit values were determined and distributed to the shareholders in accordance with various shareholder agreements and then discounted to the valuation date. For the Private Company Case, the scenariobased current Company value was used as input into a Black Scholes option pricing model, which allocated this value to the various components of the capital structure. Based on the weightings applied to the scenarios and methodologies utilized, we determined a value for the ordinary shares under the PWERM. The valuations took into account the factors described above and used a combination of financial and marketbased methodologies to determine our business enterprise value. The following details the ordinary share valuations during 2017. Fair market value February $ 50.70 May $ 65.50 June $ 69.03 August $ 78.25 September $ 87.68 November $ 90.65 December $ 120.50 During the course of the year, we have shifted our scenario weightings to give higher weighting towards our public company scenarios given the progress towards our direct listing. See Note 22 to our consolidated financial statements. Further, in consideration of an increased volume in secondary market transactions, we increased the weighting of secondary market transactions from 20% to 50% of the fair value of our ordinary shares in December 2017. Content We incur royalty costs for the right to stream music to our Users, paid to certain music record labels and other rights holders. Royalties are calculated using negotiated rates in accordance with license agreements, or estimates of those rates in instances where rights holders are not identified. Calculations are based on either Premium and AdSupported revenue earned or User/usage measures or a combination of these. The rights holder agreements are complex and our determination of royalties payable involves certain significant judgments, assumptions, and estimates in addition to complex systems and a significant volume of data to be processed and analyzed. In particular, in certain jurisdictions rights holders have several years to claim royalties for works streamed each month. As such, the royalty costs incurred in a period might not be fully settled for a number of 83

Spotify F1 | Interactive Prospectus Page 89 Page 91

Spotify F1 | Interactive Prospectus Page 89 Page 91