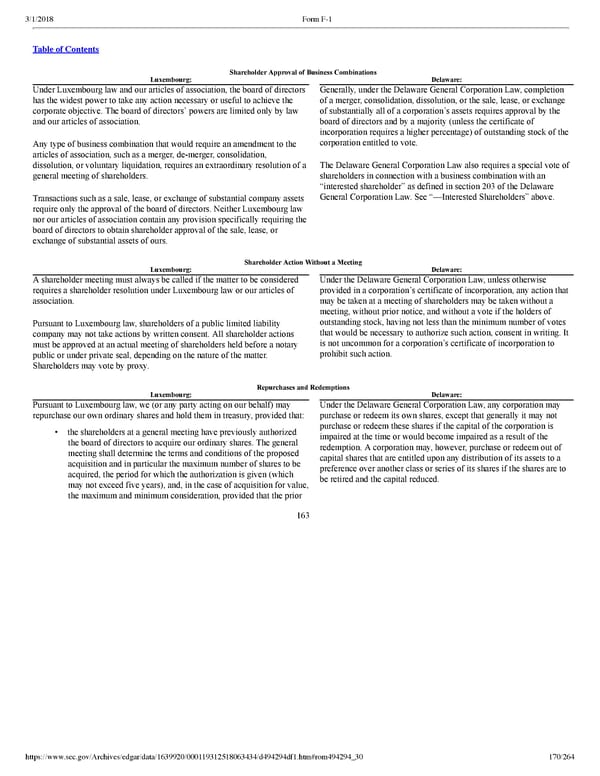

170/264 Shareholder Approval of Business Combinations Luxembourg: Delaware: Under Luxembourg law and our articles of association, the board of directors has the widest power to take any action necessary or useful to achieve the corporate objective. The board of directors’ powers are limited only by law and our articles of association. Any type of business combination that would require an amendment to the articles of association, such as a merger, demerger, consolidation, dissolution, or voluntary liquidation, requires an extraordinary resolution of a general meeting of shareholders. Transactions such as a sale, lease, or exchange of substantial company assets require only the approval of the board of directors. Neither Luxembourg law nor our articles of association contain any provision specifically requiring the board of directors to obtain shareholder approval of the sale, lease, or exchange of substantial assets of ours. Generally, under the Delaware General Corporation Law, completion of a merger, consolidation, dissolution, or the sale, lease, or exchange of substantially all of a corporation’s assets requires approval by the board of directors and by a majority (unless the certificate of incorporation requires a higher percentage) of outstanding stock of the corporation entitled to vote. The Delaware General Corporation Law also requires a special vote of shareholders in connection with a business combination with an “interested shareholder” as defined in section 203 of the Delaware General Corporation Law. See “—Interested Shareholders” above. Shareholder Action Without a Meeting Luxembourg: Delaware: A shareholder meeting must always be called if the matter to be considered requires a shareholder resolution under Luxembourg law or our articles of association. Pursuant to Luxembourg law, shareholders of a public limited liability company may not take actions by written consent. All shareholder actions must be approved at an actual meeting of shareholders held before a notary public or under private seal, depending on the nature of the matter. Shareholders may vote by proxy. Under the Delaware General Corporation Law, unless otherwise provided in a corporation’s certificate of incorporation, any action that may be taken at a meeting of shareholders may be taken without a meeting, without prior notice, and without a vote if the holders of outstanding stock, having not less than the minimum number of votes that would be necessary to authorize such action, consent in writing. It is not uncommon for a corporation’s certificate of incorporation to prohibit such action. Repurchases and Redemptions Luxembourg: Delaware: Pursuant to Luxembourg law, we (or any party acting on our behalf) may repurchase our own ordinary shares and hold them in treasury, provided that: • the shareholders at a general meeting have previously authorized the board of directors to acquire our ordinary shares. The general meeting shall determine the terms and conditions of the proposed acquisition and in particular the maximum number of shares to be acquired, the period for which the authorization is given (which may not exceed five years), and, in the case of acquisition for value, the maximum and minimum consideration, provided that the prior Under the Delaware General Corporation Law, any corporation may purchase or redeem its own shares, except that generally it may not purchase or redeem these shares if the capital of the corporation is impaired at the time or would become impaired as a result of the redemption. A corporation may, however, purchase or redeem out of capital shares that are entitled upon any distribution of its assets to a preference over another class or series of its shares if the shares are to be retired and the capital reduced. 163

Spotify F1 | Interactive Prospectus Page 169 Page 171

Spotify F1 | Interactive Prospectus Page 169 Page 171