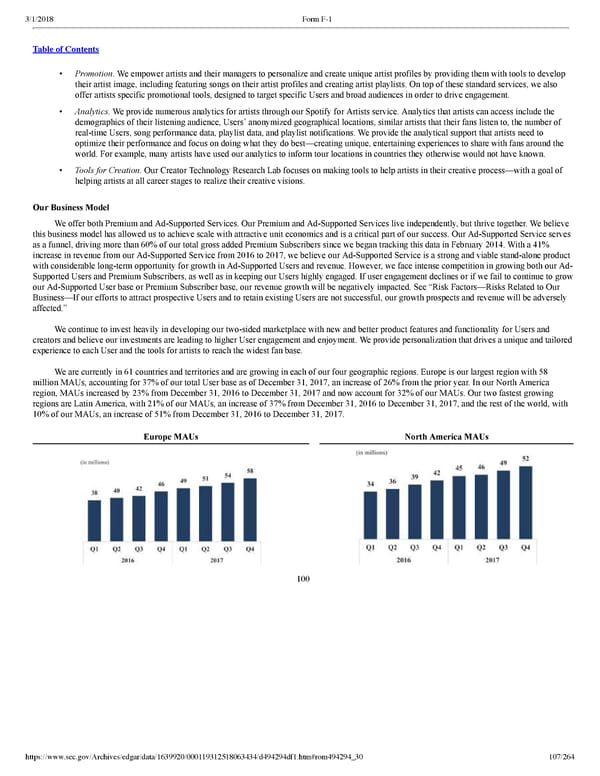

107/264 • Promotion . We empower artists and their managers to personalize and create unique artist profiles by providing them with tools to develop their artist image, including featuring songs on their artist profiles and creating artist playlists. On top of these standard services, we also offer artists specific promotional tools, designed to target specific Users and broad audiences in order to drive engagement. • Analytics . We provide numerous analytics for artists through our Spotify for Artists service. Analytics that artists can access include the demographics of their listening audience, Users’ anonymized geographical locations, similar artists that their fans listen to, the number of realtime Users, song performance data, playlist data, and playlist notifications. We provide the analytical support that artists need to optimize their performance and focus on doing what they do best—creating unique, entertaining experiences to share with fans around the world. For example, many artists have used our analytics to inform tour locations in countries they otherwise would not have known. • Tools for Creation. Our Creator Technology Research Lab focuses on making tools to help artists in their creative process—with a goal of helping artists at all career stages to realize their creative visions. Our Business Model We offer both Premium and AdSupported Services. Our Premium and AdSupported Services live independently, but thrive together. We believe this business model has allowed us to achieve scale with attractive unit economics and is a critical part of our success. Our AdSupported Service serves as a funnel, driving more than 60% of our total gross added Premium Subscribers since we began tracking this data in February 2014. With a 41% increase in revenue from our AdSupported Service from 2016 to 2017, we believe our AdSupported Service is a strong and viable standalone product with considerable longterm opportunity for growth in AdSupported Users and revenue. However, we face intense competition in growing both our Ad Supported Users and Premium Subscribers, as well as in keeping our Users highly engaged. If user engagement declines or if we fail to continue to grow our AdSupported User base or Premium Subscriber base, our revenue growth will be negatively impacted. See “Risk Factors—Risks Related to Our Business—If our efforts to attract prospective Users and to retain existing Users are not successful, our growth prospects and revenue will be adversely affected.” We continue to invest heavily in developing our twosided marketplace with new and better product features and functionality for Users and creators and believe our investments are leading to higher User engagement and enjoyment. We provide personalization that drives a unique and tailored experience to each User and the tools for artists to reach the widest fan base. We are currently in 61 countries and territories and are growing in each of our four geographic regions. Europe is our largest region with 58 million MAUs, accounting for 37% of our total User base as of December 31, 2017, an increase of 26% from the prior year. In our North America region, MAUs increased by 23% from December 31, 2016 to December 31, 2017 and now account for 32% of our MAUs. Our two fastest growing regions are Latin America, with 21% of our MAUs, an increase of 37% from December 31, 2016 to December 31, 2017, and the rest of the world, with 10% of our MAUs, an increase of 51% from December 31, 2016 to December 31, 2017. Europe MAUs North America MAUs 100

Spotify F1 | Interactive Prospectus Page 106 Page 108

Spotify F1 | Interactive Prospectus Page 106 Page 108