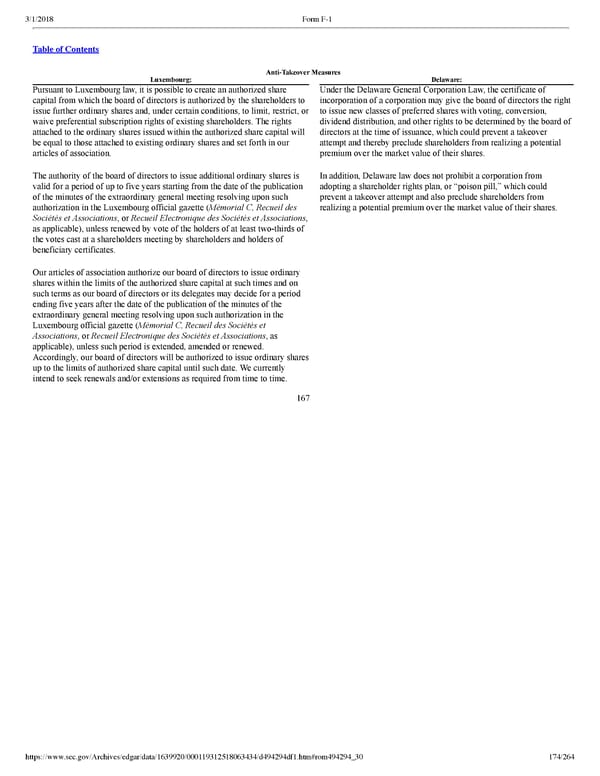

174/264 AntiTakeover Measures Luxembourg: Delaware: Pursuant to Luxembourg law, it is possible to create an authorized share capital from which the board of directors is authorized by the shareholders to issue further ordinary shares and, under certain conditions, to limit, restrict, or waive preferential subscription rights of existing shareholders. The rights attached to the ordinary shares issued within the authorized share capital will be equal to those attached to existing ordinary shares and set forth in our articles of association. The authority of the board of directors to issue additional ordinary shares is valid for a period of up to five years starting from the date of the publication of the minutes of the extraordinary general meeting resolving upon such authorization in the Luxembourg official gazette ( Mémorial C, Recueil des Sociétés et Associations , or Recueil Electronique des Sociétés et Associations , as applicable), unless renewed by vote of the holders of at least twothirds of the votes cast at a shareholders meeting by shareholders and holders of beneficiary certificates. Our articles of association authorize our board of directors to issue ordinary shares within the limits of the authorized share capital at such times and on such terms as our board of directors or its delegates may decide for a period ending five years after the date of the publication of the minutes of the extraordinary general meeting resolving upon such authorization in the Luxembourg official gazette ( Mémorial C, Recueil des Sociétés et Associations , or Recueil Electronique des Sociétés et Associations , as applicable), unless such period is extended, amended or renewed. Accordingly, our board of directors will be authorized to issue ordinary shares up to the limits of authorized share capital until such date. We currently intend to seek renewals and/or extensions as required from time to time. Under the Delaware General Corporation Law, the certificate of incorporation of a corporation may give the board of directors the right to issue new classes of preferred shares with voting, conversion, dividend distribution, and other rights to be determined by the board of directors at the time of issuance, which could prevent a takeover attempt and thereby preclude shareholders from realizing a potential premium over the market value of their shares. In addition, Delaware law does not prohibit a corporation from adopting a shareholder rights plan, or “poison pill,” which could prevent a takeover attempt and also preclude shareholders from realizing a potential premium over the market value of their shares. 167

Spotify F1 | Interactive Prospectus Page 173 Page 175

Spotify F1 | Interactive Prospectus Page 173 Page 175